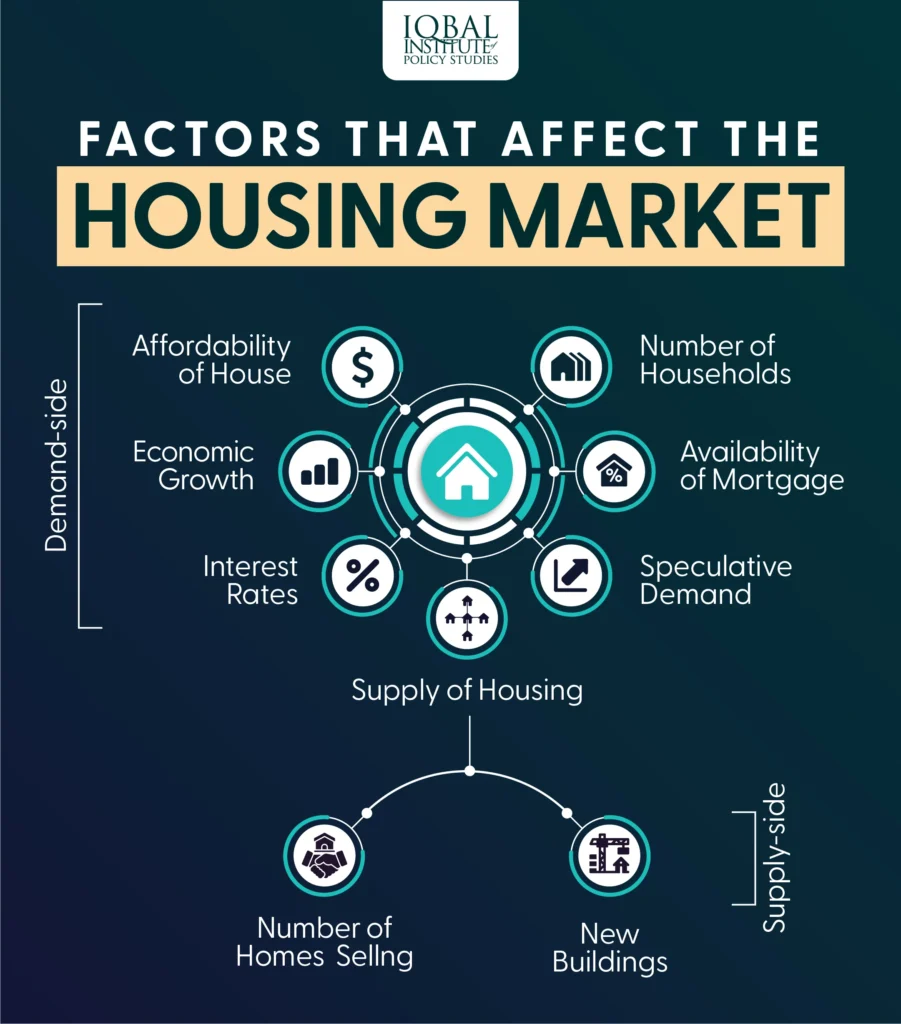

Real Estate Trends: Economic Factors Influencing The Housing Market are crucial in understanding the fluctuations and patterns within the real estate industry. The housing market is directly impacted by economic factors such as interest rates, employment levels, consumer confidence, and income levels. These factors play a significant role in shaping the demand for housing, influencing property values, and determining the overall health of the real estate market. As a result, real estate professionals and potential homebuyers closely monitor economic indicators to make informed decisions about buying, selling, or investing in properties.

In addition to Real Estate Trends: Economic Factors Influencing The Housing Market, it is important to consider other key elements that can affect the housing market. Factors such as population growth, urbanization, government policies, and environmental sustainability also play a significant role in shaping the real estate landscape. These factors can influence the demand for housing in certain areas, drive development and construction projects, and impact property values. Understanding the interplay between economic factors and these alternative influences is essential for comprehending the dynamic nature of the housing market.

Economic Factors Affecting the Real Estate Market

When it comes to the housing market, economic factors play a crucial role in determining the demand, supply, and pricing of properties. Factors such as interest rates, employment levels, income growth, and consumer confidence all have a direct impact on the real estate market. For example, when interest rates are low, it becomes more affordable for people to borrow money for a mortgage, leading to an increase in home sales and prices. Conversely, when interest rates are high, borrowing becomes more expensive, resulting in a decrease in demand for homes and a potential decrease in prices.

Additionally, employment levels and income growth are important economic indicators that influence the real estate market. When unemployment rates are low and incomes are rising, people are more likely to purchase homes, leading to an increase in demand. On the other hand, high unemployment rates and stagnant income growth can lead to a decrease in home sales and a potential decline in property values. Consumer confidence also plays a significant role in the real estate market, as people are more willing to make large financial commitments, such as buying a home, when they feel optimistic about the economy and their own financial situation.

Impact of Interest Rates on the Housing Market

Interest rates have a significant impact on the housing market as they directly affect the cost of borrowing money for a mortgage. When interest rates are low, it becomes more affordable for potential homebuyers to finance a home purchase, leading to an increase in demand for housing. This high demand can drive up home prices, making it a seller’s market. On the other hand, when interest rates are high, borrowing becomes more expensive, resulting in a decrease in demand for homes and potentially lower property prices. As a result, interest rates can greatly influence the affordability of homes and the overall health of the real estate market.

Moreover, fluctuating interest rates can also impact the decision-making process of homeowners looking to refinance their existing mortgages. When interest rates are low, homeowners are more likely to refinance their mortgages to take advantage of lower monthly payments, which can free up more disposable income for other expenditures. Conversely, when interest rates are high, the incentive to refinance diminishes, and homeowners may be less inclined to invest in their properties or make significant financial decisions, which can have a ripple effect on the housing market.

Unemployment Rates and the Real Estate Market

Unemployment rates have a direct impact on the real estate market, as they influence the ability of individuals and families to afford homeownership. When unemployment rates are low, more people are employed and have a steady source of income, making them more likely to qualify for a mortgage and purchase a home. This can lead to an increase in demand for housing and a potential rise in property prices. Conversely, high unemployment rates can result in a decrease in demand for homes, as fewer people have the financial stability to make such a significant investment. This decrease in demand can lead to a surplus of housing inventory and potentially lower property values.

Furthermore, unemployment rates can also affect the rental market, as individuals who are unemployed or underemployed may have difficulty paying rent, leading to an increase in rental vacancies and a potential decrease in rental prices. This can impact real estate investors and landlords, as well as the overall stability of the housing market. As such, unemployment rates are a key economic factor that can influence both the buying and renting aspects of the real estate market.

Income Growth and Housing Market Trends

Income growth is a critical economic factor that influences housing market trends, as it directly impacts the purchasing power of potential homebuyers. When incomes are rising, individuals and families have more disposable income, making it easier for them to afford homeownership. This can lead to an increase in demand for housing and potentially drive up property prices. Conversely, stagnant or declining income growth can result in a decrease in purchasing power, leading to a potential decrease in demand for homes and a more balanced or even a buyer’s market.

Moreover, income growth also plays a significant role in the rental market, as individuals with higher incomes may be willing to pay more for rent, leading to an increase in rental prices. On the other hand, if income growth is limited, renters may be more price-sensitive, leading to a potential decrease in rental prices. As such, income growth is a crucial economic factor that influences both the buying and renting aspects of the housing market and can have a significant impact on overall market trends.

Consumer Confidence and Real Estate Market Activity

Consumer confidence is a key economic factor that influences real estate market activity, as it reflects the overall sentiment and optimism of consumers regarding the economy and their own financial well-being. When consumer confidence is high, people are more likely to make significant financial commitments, such as purchasing a home, as they feel optimistic about the stability of the economy and their ability to make long-term investments. This can lead to an increase in housing market activity, including higher demand for homes and potential increases in property prices.

Conversely, when consumer confidence is low, individuals may be more hesitant to make large financial commitments, leading to a decrease in housing market activity. This can result in a decrease in demand for homes and potentially lower property prices, as people may be more inclined to hold off on making significant investments until they feel more confident about the state of the economy. As such, consumer confidence plays a crucial role in influencing the overall activity and stability of the real estate market.

| Economic Factor | Influence on Housing Market |

|---|---|

| Interest Rates | Higher interest rates can decrease affordability and lower demand for housing. |

| Unemployment Rate | High unemployment rates can lead to lower demand for housing and potential foreclosures. |

| Economic Growth | Strong economic growth can lead to higher demand for housing and increased property values. |

| Housing Supply | Low housing supply can drive up prices and lead to bidding wars among buyers. |

conclusıon

Real Estate Trends: Economic Factors Influencing The Housing Market konusu, konut piyasasını etkileyen ekonomik faktörlerin birçok açıdan önemli olduğunu göstermektedir. Faiz oranları, işsizlik oranı, ekonomik büyüme ve konut arzı gibi faktörler, konut talebi, fiyatları ve piyasa döngüsünü etkileyebilmektedir.