Understanding Fiscal Policy: Government Spending, Taxation, And Economic Growth are crucial components of a country’s economic management. Fiscal policy refers to the government’s use of taxation and spending to influence the economy. Government spending can stimulate economic growth through investment in infrastructure, education, and healthcare, while taxation can affect consumer spending and business investment. Finding the right balance between government spending and taxation is essential for promoting economic growth and stability.

Fiscal policy plays a critical role in shaping the overall economic environment of a country. It encompasses the government’s decisions regarding spending, taxation, and borrowing, all of which have direct implications for economic growth and stability. By adjusting government spending, policymakers can influence the level of aggregate demand in the economy, while changes in taxation can impact households’ disposable income and businesses’ investment decisions. Understanding how these policy tools interact and their effects on economic growth is essential for policymakers and economists alike.

In addition to government spending and taxation, fiscal policy also encompasses other important tools such as deficit financing, public debt management, and fiscal sustainability. These aspects are crucial for understanding the long-term implications of fiscal policy on economic growth and stability. Deficit financing, for example, can stimulate short-term economic growth but may lead to higher public debt levels in the long run. Similarly, effective public debt management is essential for maintaining investor confidence and ensuring fiscal sustainability. Overall, a comprehensive understanding of fiscal policy is necessary for assessing its impact on economic growth and ensuring long-term stability.

Understanding Fiscal Policy: Government Spending, Taxation, And Economic Growth

Fiscal policy refers to the government’s use of spending and taxation to influence the economy. By adjusting the levels of government spending and taxation, fiscal policy aims to achieve economic growth, price stability, and full employment. Government spending includes expenditures on goods and services, infrastructure, education, healthcare, and social welfare programs. Taxation, on the other hand, involves the collection of revenue from individuals and businesses to fund government activities and services.

Government spending can directly stimulate economic growth by creating demand for goods and services and providing employment opportunities. However, excessive government spending can lead to budget deficits and inflation if not balanced with taxation. Taxation can also influence economic growth by affecting consumer and business behavior. Lower taxes can encourage spending and investment, while higher taxes can reduce disposable income and discourage economic activity. Understanding the relationship between government spending, taxation, and economic growth is crucial for policymakers and economists in formulating effective fiscal policies.

The Role of Government Spending in Economic Growth

Government spending plays a significant role in driving economic growth by directly impacting aggregate demand. When the government invests in infrastructure projects, such as building roads, bridges, and public transportation systems, it creates jobs and stimulates economic activity. Additionally, government spending on education and healthcare can improve human capital and productivity, contributing to long-term economic growth. However, excessive government spending without proper revenue generation can lead to budget deficits and crowding out private investment, which can hinder economic growth in the long run.

Moreover, government spending on social welfare programs, such as unemployment benefits and food assistance, can provide a safety net for individuals during economic downturns, reducing the negative impact of recessions on consumer spending. Overall, government spending can be a powerful tool for stimulating economic growth when allocated efficiently and balanced with sustainable revenue sources.

The Impact of Taxation on Economic Growth

Taxation can significantly impact economic growth by influencing consumer spending, saving, and investment. When individuals and businesses are subject to higher taxes, they have less disposable income and reduced incentives to spend and invest. On the other hand, lower taxes can stimulate consumer spending and business investment, potentially boosting economic growth. Moreover, the structure of taxation, such as progressive or regressive tax systems, can also impact income distribution and overall economic growth.

However, it’s essential to consider the trade-offs of taxation, as lower tax revenue can limit the government’s ability to fund essential services and infrastructure, potentially hindering long-term economic growth. Additionally, the efficiency and fairness of tax policies can influence economic behavior and overall growth prospects. Therefore, understanding the impact of taxation on economic growth is crucial for designing effective fiscal policies that balance revenue generation with economic incentives.

Fiscal Policy Tools for Economic Stabilization

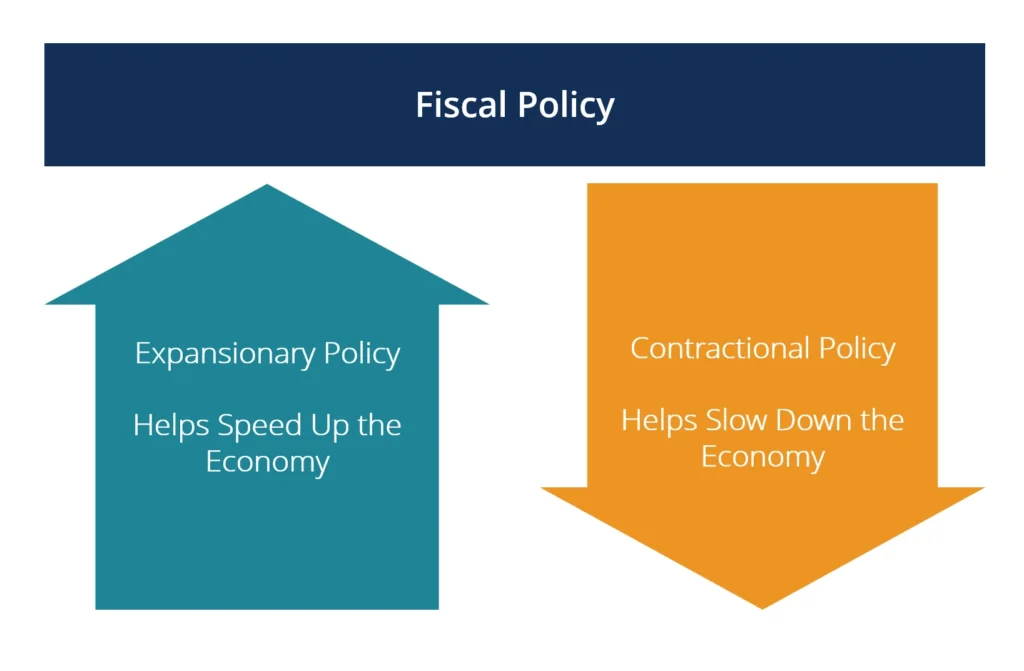

Fiscal policy utilizes various tools to achieve economic stabilization, including discretionary fiscal policy and automatic stabilizers. Discretionary fiscal policy involves deliberate changes in government spending and taxation to counteract economic fluctuations. For example, during a recession, the government can increase spending and reduce taxes to stimulate demand and support economic recovery. Conversely, during periods of high inflation, the government can reduce spending and increase taxes to cool down the economy.

Automatic stabilizers, such as progressive income taxes and unemployment benefits, automatically adjust government revenue and spending in response to economic conditions. During economic downturns, automatic stabilizers increase government spending and reduce tax revenue, providing a cushion for households and businesses. These tools help stabilize the economy by mitigating the impact of fluctuations in economic activity, contributing to sustained growth and stability.

Challenges of Fiscal Policy Implementation

Implementing effective fiscal policy poses several challenges for policymakers, including the timing and magnitude of policy changes, political considerations, and the accuracy of economic forecasts. The timing of fiscal policy measures is crucial, as delayed or untimely interventions can dampen their effectiveness in addressing economic challenges. Moreover, determining the appropriate magnitude of fiscal stimulus or restraint requires careful consideration of the current economic conditions and potential multiplier effects.

Political considerations and constraints can also influence the implementation of fiscal policy, as conflicting interests and ideologies may hinder consensus on policy measures. Additionally, the accuracy of economic forecasts and data is essential for informing fiscal policy decisions, as inaccurate assessments can lead to suboptimal outcomes. Addressing these challenges requires a comprehensive understanding of fiscal policy tools and their potential impacts, as well as effective coordination among policymakers, economists, and other stakeholders.

Fiscal Policy and Long-Term Economic Growth

Fiscal policy plays a crucial role in shaping long-term economic growth by influencing investment, productivity, and innovation. Government spending on education, research and development, and infrastructure can enhance the economy’s productive capacity and competitiveness. By investing in human capital and technological advancements, fiscal policy can contribute to sustained economic growth and improved living standards.

Moreover, sound fiscal policies that maintain fiscal sustainability and a stable macroeconomic environment can provide a conducive environment for private sector investment and entrepreneurship. However, unsustainable fiscal policies characterized by high levels of government debt and deficits can undermine long-term growth prospects and lead to fiscal crises. Therefore, promoting fiscal responsibility and strategic allocation of resources are essential for fostering long-term economic growth and prosperity.

Fiscal Policy and Income Distribution

Fiscal policy can influence income distribution through progressive taxation, social welfare programs, and targeted spending initiatives. Progressive taxation, which imposes higher tax rates on higher-income individuals, can mitigate income inequality by redistributing wealth and funding social programs. Additionally, government spending on healthcare, education, and poverty alleviation can help reduce disparities in access to essential services and opportunities.

However, the design and implementation of fiscal policies aimed at addressing income inequality require careful consideration of their potential impacts on economic incentives and efficiency. Moreover, the effectiveness of fiscal measures in addressing income distribution depends on the overall economic environment and labor market dynamics. Balancing the goals of promoting economic growth and equity is essential for designing fiscal policies that contribute to inclusive and sustainable development.

International Implications of Fiscal Policy

Fiscal policy decisions in one country can have international implications, affecting global trade, capital flows, and exchange rates. Changes in government spending and taxation can influence a country’s competitiveness and trade balances, impacting its relationships with trading partners. Moreover, fiscal policy measures, such as tax incentives and subsidies, can affect cross-border investment and business activities.

Furthermore, fiscal policies can influence global economic stability and coordination, as coordinated fiscal actions among countries can mitigate the spillover effects of economic shocks and promote sustainable growth. However, conflicting fiscal policies and protectionist measures can lead to trade tensions and disrupt international economic relations. Therefore, understanding the international implications of fiscal policy is crucial for policymakers and stakeholders involved in global economic governance.

The Role of Fiscal Policy in Addressing Economic Crises

Fiscal policy plays a critical role in addressing economic crises, such as recessions and financial turmoil, by providing stimulus and support to the economy. During recessions, expansionary fiscal policies, including increased government spending and tax cuts, can bolster demand and employment, helping to mitigate the impact of the downturn. Moreover, fiscal measures aimed at stabilizing financial markets and restoring confidence can contribute to a swift recovery.

However, the effectiveness of fiscal policy in addressing economic crises depends on the coordination with monetary policy, as well as the adequacy of fiscal resources and the flexibility of policy measures. Additionally, addressing the root causes of economic crises, such as financial imbalances and structural weaknesses, requires comprehensive fiscal reforms and policy adjustments. Therefore, leveraging fiscal policy to address economic crises necessitates a strategic and coordinated approach that addresses immediate challenges while laying the groundwork for long-term resilience.

Measuring the Effectiveness of Fiscal Policy

Assessing the effectiveness of fiscal policy involves evaluating its impact on economic indicators, such as GDP growth, unemployment rates, inflation, and public finances. By analyzing the outcomes of fiscal policy measures, policymakers can gauge their efficacy in achieving economic stabilization and growth objectives. Additionally, assessing the distributional effects of fiscal policies on different income groups and sectors is essential for understanding their broader impacts.

Moreover, considering the dynamic and interconnected nature of the economy, assessing the effectiveness of fiscal policy requires accounting for potential lagged effects, spillovers, and unintended consequences. By employing empirical analysis and economic modeling, policymakers and researchers can gain insights into the effectiveness of fiscal policy tools and inform future policy decisions. Continuous evaluation and refinement of fiscal policy strategies are crucial for adapting to evolving economic conditions and achieving sustainable and inclusive growth.

| Concept | Description |

|---|---|

| Fiscal Policy | The use of government spending and taxation to influence the economy. |

| Government Spending | The amount of money the government spends on goods, services, and infrastructure. |

| Taxation | The process of collecting taxes from individuals and businesses to fund government activities. |

| Economic Growth | An increase in the production and consumption of goods and services in an economy. |

Conclusion

Understanding Fiscal Policy: Government Spending, Taxation, And Economic Growth

Fiscal policy refers to the government’s use of spending and taxation to influence the economy. Government spending involves the allocation of funds for various purposes, while taxation involves collecting money from individuals and businesses to fund government activities. The goal of fiscal policy is to promote economic growth, which is characterized by an increase in the production and consumption of goods and services within an economy.