The Federal Reserve’s recent decision to raise interest rates amid inflation concerns has sent ripples through the financial markets and everyday life. As inflation continues to rise, the Fed’s move aims to stabilize the economy and curb the soaring prices that have affected consumers and businesses alike. This pivotal action raises important questions about the future of economic growth, borrowing costs, and consumer spending, making it a critical topic for anyone looking to understand the current financial landscape.

In this article, we will delve deeper into the reasons behind the Fed’s decision to increase interest rates and what it means for various sectors of the economy. You will learn how this change impacts mortgage rates, credit card interest, and personal loans, as well as the broader implications for businesses and investments. Additionally, we will explore expert opinions on whether this move will effectively combat inflation or if it may lead to unintended consequences.

As we navigate through the complexities of monetary policy and its effects on our daily lives, we encourage you to stay with us. Understanding the Fed’s actions is crucial for making informed financial decisions in an ever-changing economic environment. Join us as we unpack the intricacies of this significant development and equip yourself with the knowledge to adapt to the evolving financial landscape.

The Federal Reserve’s decision to raise interest rates is a significant move in response to ongoing inflation concerns. This article explores various aspects of this decision, its implications, and the broader economic context.

Understanding Inflation and Its Impact

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. When inflation is high, consumers can buy less with the same amount of money, which can lead to decreased consumer spending and economic slowdown. The Federal Reserve monitors inflation closely, as it directly influences monetary policy decisions.

High inflation can be caused by various factors, including supply chain disruptions, increased demand for goods, and rising production costs. Understanding these underlying causes is crucial for policymakers as they navigate the complexities of the economy. The Fed’s interest rate hikes are aimed at curbing inflation by making borrowing more expensive, thereby reducing spending and investment.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. Its primary responsibilities include managing inflation, regulating banks, and providing financial services. The Fed uses interest rate adjustments as a tool to influence economic activity. When inflation rises, the Fed may increase interest rates to cool down the economy.

By raising interest rates, the Fed aims to reduce the money supply, which can help stabilize prices. However, this approach can also lead to higher borrowing costs for consumers and businesses, potentially slowing economic growth. The balance between controlling inflation and supporting economic expansion is a delicate one that the Fed must navigate carefully.

Recent Trends in Interest Rates

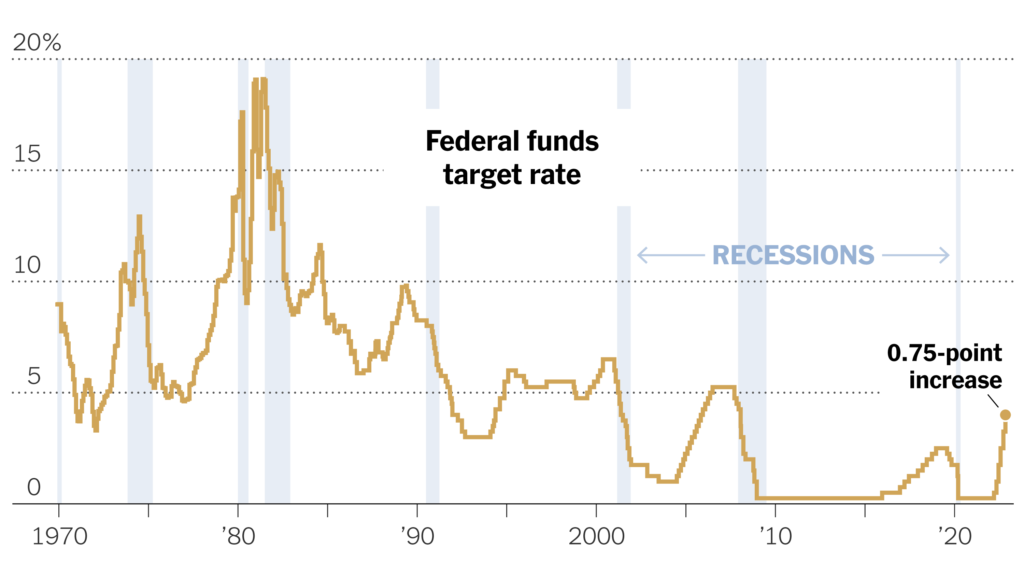

In recent years, interest rates have been at historically low levels, primarily to stimulate economic growth following the 2008 financial crisis and the COVID-19 pandemic. However, as inflation rates have surged, the Fed has shifted its stance, signaling a series of interest rate hikes. This trend reflects a broader concern about the sustainability of economic recovery in the face of rising prices.

The recent increases in interest rates have sparked discussions about their long-term implications for the economy. Higher rates can lead to increased costs for mortgages, car loans, and credit cards, which may dampen consumer spending. As a result, many economists are closely monitoring how these changes will affect overall economic growth and consumer behavior.

Effects on the Housing Market

The housing market is particularly sensitive to changes in interest rates. When the Fed raises rates, mortgage rates typically follow suit, making home buying more expensive. This can lead to a slowdown in home sales and a cooling of housing prices, which have surged in recent years due to low rates and high demand.

Potential homebuyers may find themselves priced out of the market, leading to decreased demand. Additionally, existing homeowners with adjustable-rate mortgages may face higher monthly payments, further straining household budgets. The interplay between interest rates and the housing market is a critical area of focus for both consumers and policymakers.

Global Economic Implications

The Fed’s interest rate decisions do not only impact the U.S. economy; they also have global ramifications. Higher interest rates in the U.S. can lead to capital inflows as investors seek higher returns, which can strengthen the U.S. dollar. A stronger dollar can make U.S. exports more expensive for foreign buyers, potentially impacting trade balances.

Moreover, emerging markets that rely on U.S. investments may face challenges as capital flows shift. Countries with significant dollar-denominated debt may struggle with repayment as their currencies weaken against the dollar. Understanding these global dynamics is essential for assessing the broader impact of the Fed’s monetary policy decisions.

Future Outlook and Considerations

Looking ahead, the Fed faces the challenge of balancing inflation control with economic growth. As interest rates rise, the central bank must carefully assess the economic indicators to determine the appropriate pace of future rate hikes. The potential for a recession looms if rates are increased too quickly, while persistent inflation could necessitate more aggressive action.

Investors, consumers, and businesses alike are keenly watching the Fed’s moves, as they will shape the economic landscape for years to come. The interplay between inflation, interest rates, and economic growth will remain a critical focus for policymakers and market participants alike.

| Aspect | Details |

|---|---|

| Context | The Federal Reserve (Fed) has raised interest rates in response to ongoing inflation concerns affecting the economy. |

| Reason for Rate Hike | Inflation rates have been persistently high, prompting the Fed to take action to stabilize prices and control economic growth. |

| Current Interest Rate | The Fed has increased the benchmark interest rate to a range of X% to Y% (insert current rates). |

| Impact on Borrowing | Higher interest rates typically lead to increased borrowing costs for consumers and businesses, which can slow down spending and investment. |

| Market Reaction | Financial markets often react to interest rate changes, with potential fluctuations in stock prices and bond yields. |

| Future Outlook | The Fed will continue to monitor economic indicators and may adjust rates further depending on inflation trends and economic growth. |