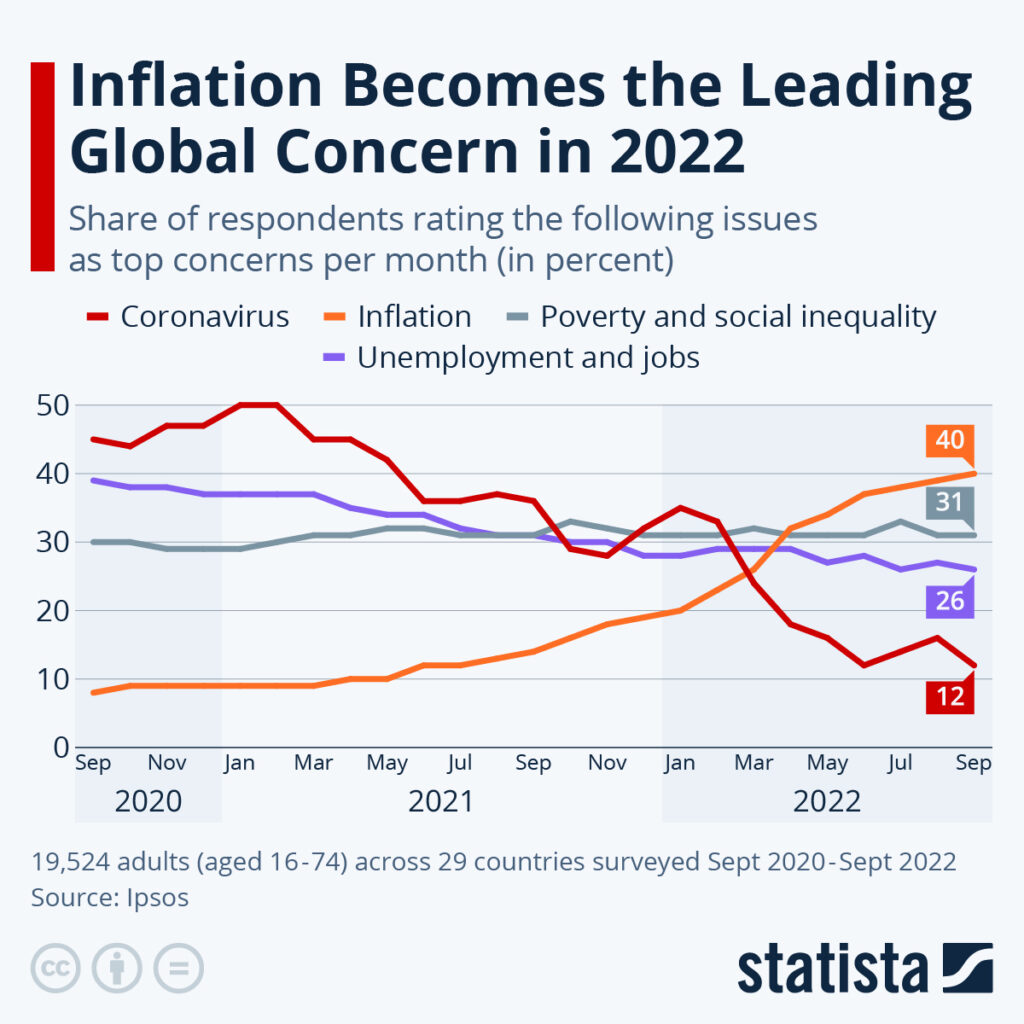

In recent months, the world has witnessed a significant surge in inflation rates, with global inflation hitting record highs in key economies. This unprecedented rise has raised concerns among policymakers, businesses, and consumers alike. As prices soar for essential goods and services, understanding the factors driving this inflationary trend becomes crucial. In this article, we will delve into the underlying causes of this phenomenon, exploring how supply chain disruptions, rising energy costs, and changing consumer behaviors contribute to the current economic landscape.

As we navigate through the complexities of global inflation, readers will gain insights into the specific sectors most affected by these rising prices. We will examine how inflation impacts everyday life, from grocery bills to housing costs, and what it means for the average consumer. Additionally, we will discuss the potential long-term effects on economic growth and stability, providing a comprehensive overview of the challenges that lie ahead.

Furthermore, this article will highlight the responses from governments and central banks around the world as they attempt to mitigate the effects of inflation. By understanding the measures being implemented, readers will be better equipped to anticipate future economic shifts. Stay with us as we unpack the intricacies of global inflation and its far-reaching implications, ensuring you are informed and prepared for what lies ahead.

Understanding the Causes of Inflation

Inflation is primarily driven by various factors, including demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when the demand for goods and services exceeds their supply, leading to price increases. On the other hand, cost-push inflation arises when the costs of production increase, causing producers to pass on those costs to consumers. Built-in inflation is related to adaptive expectations, where businesses and workers expect prices to rise, leading to wage increases and further price hikes.

In recent times, the COVID-19 pandemic has disrupted supply chains globally, contributing to both demand-pull and cost-push inflation. As economies reopened, pent-up demand surged, while supply chain bottlenecks limited the availability of goods, exacerbating inflationary pressures. Understanding these causes is crucial for policymakers aiming to implement effective measures to control inflation.

The Impact of Inflation on Consumer Behavior

As inflation rises, consumer behavior tends to shift significantly. Higher prices can lead to decreased purchasing power, prompting consumers to prioritize essential goods over luxury items. This shift can result in changes in spending patterns, with consumers seeking discounts, switching to cheaper alternatives, or delaying purchases altogether.

Moreover, inflation can create uncertainty in the market, leading consumers to adopt a more cautious approach to spending. This behavior can further impact businesses, as reduced consumer spending may lead to lower revenues and potential layoffs, creating a cycle that can exacerbate economic downturns.

Central Banks’ Response to Inflation

Central banks play a critical role in managing inflation through monetary policy. When inflation rates rise, central banks may increase interest rates to curb spending and borrowing, aiming to stabilize prices. This approach can have a cooling effect on the economy, as higher interest rates typically lead to reduced consumer and business spending.

However, the timing and magnitude of these interest rate adjustments are crucial. If implemented too aggressively, they can stifle economic growth, while a delayed response may allow inflation to spiral out of control. Central banks must carefully balance these factors to maintain economic stability.

Inflation’s Effect on Investment Strategies

Investors often reassess their strategies in response to rising inflation. Traditional fixed-income investments, such as bonds, may become less attractive as their real returns diminish in an inflationary environment. Consequently, investors may seek assets that historically perform well during inflationary periods, such as real estate, commodities, and inflation-protected securities.

Additionally, equities can serve as a hedge against inflation, as companies may pass on rising costs to consumers, potentially maintaining profit margins. Understanding these dynamics is essential for investors looking to navigate the complexities of an inflationary landscape.

Global Variations in Inflation Rates

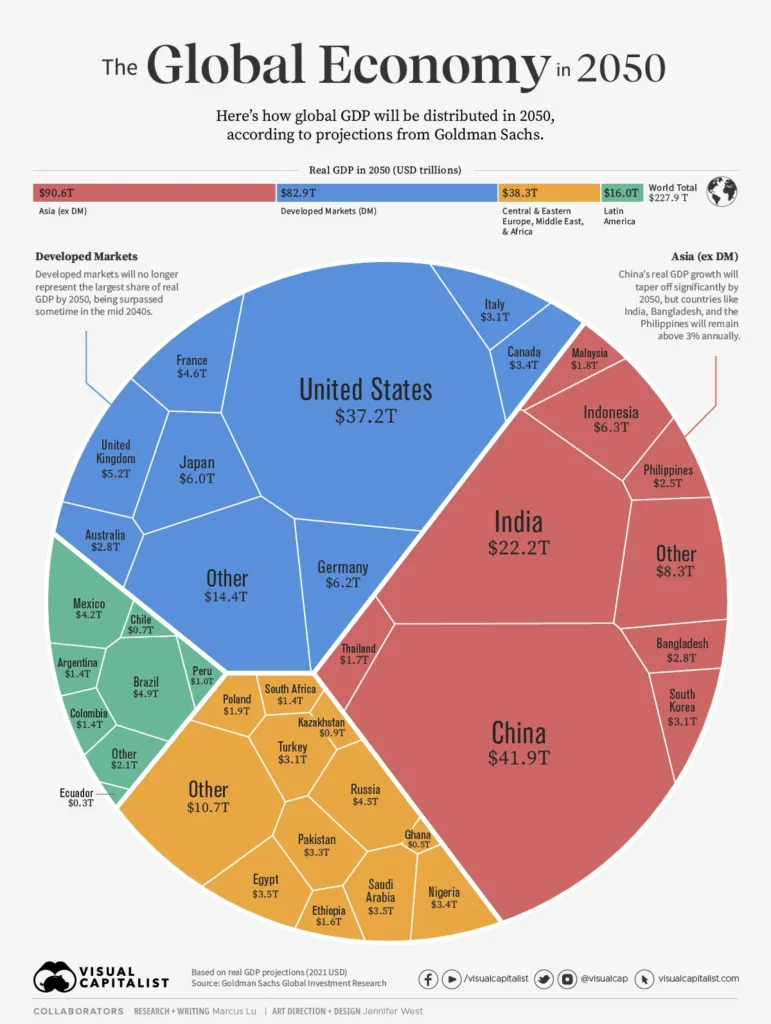

Inflation rates can vary significantly across different countries and regions, influenced by local economic conditions, government policies, and external factors. For instance, emerging economies may experience higher inflation rates due to rapid growth and increased demand, while developed nations may face more moderate inflation due to established market structures.

Comparing inflation rates globally can provide insights into economic health and stability. For example, countries with high inflation may struggle with currency depreciation, while those with low inflation may enjoy stronger purchasing power. Understanding these variations is crucial for businesses and investors operating in a global market.

Future Outlook: Inflation Trends and Predictions

Looking ahead, economists and analysts are closely monitoring inflation trends to make predictions about future economic conditions. Factors such as supply chain recovery, labor market dynamics, and geopolitical events will play a significant role in shaping inflation trajectories. Some experts predict that inflation may stabilize as supply chains normalize, while others caution that persistent demand pressures could keep inflation elevated.

Ultimately, the future of inflation will depend on a complex interplay of domestic and global factors. Policymakers, businesses, and consumers must remain vigilant and adaptable to navigate the evolving economic landscape.

| Country | Current Inflation Rate (%) | Key Factors Contributing to Inflation | Government Response |

|---|---|---|---|

| United States | 8.6 | Supply chain disruptions, increased consumer demand, rising energy prices | Interest rate hikes by the Federal Reserve, stimulus checks |

| Eurozone | 7.5 | Energy crisis, post-pandemic recovery, geopolitical tensions | Monetary policy adjustments by the European Central Bank |

| United Kingdom | 9.1 | High energy costs, labor shortages, Brexit-related trade issues | Bank of England’s interest rate increases, fiscal support measures |

| Canada | 6.8 | Supply chain issues, housing market pressures, rising food prices | Bank of Canada’s monetary tightening, government subsidies |

| Australia | 5.1 | Global supply chain disruptions, increased demand post-lockdown | Reserve Bank of Australia’s interest rate adjustments |

Conclusion

Global inflation has reached unprecedented levels across major economies, driven by a combination of supply chain disruptions, rising energy prices, and increased consumer demand. Governments and central banks are responding with various monetary and fiscal measures to mitigate the impact on their economies.