India Bank Deposit Insurance is a crucial aspect of safeguarding the financial interests of depositors. In a country where household savings are vital for economic stability, understanding the nuances of bank deposit insurance in India is essential. The Reserve Bank of India (RBI) has established deposit insurance coverage to protect depositors, yet many wonder if the current limits are sufficient to ensure safety in times of financial distress. With deposit insurance limits standing at a modest ₹ 5 lakh per depositor, the risk remains significant for larger account holders. This highlights an urgent need for discussions around enhancing depositors protection in India, to foster greater financial stability for all.

The protection offered to savers through India’s banking system, often referred to as banking insurance or deposit cover, is pivotal for reinforcing depositor confidence. This safety net serves as a buffer against potential bank failures, ensuring that individuals can recover their savings even in turbulent financial times. However, the current framework raises concerns about the adequacy of RBI deposit insurance coverage, particularly in light of growing household wealth. As more individuals seek to secure their financial futures, it becomes imperative to assess the effectiveness of existing deposit insurance limits. Ultimately, a deeper exploration of depositors’ protection in India is necessary to secure a robust and resilient financial ecosystem.

Understanding India’s Bank Deposit Insurance Framework

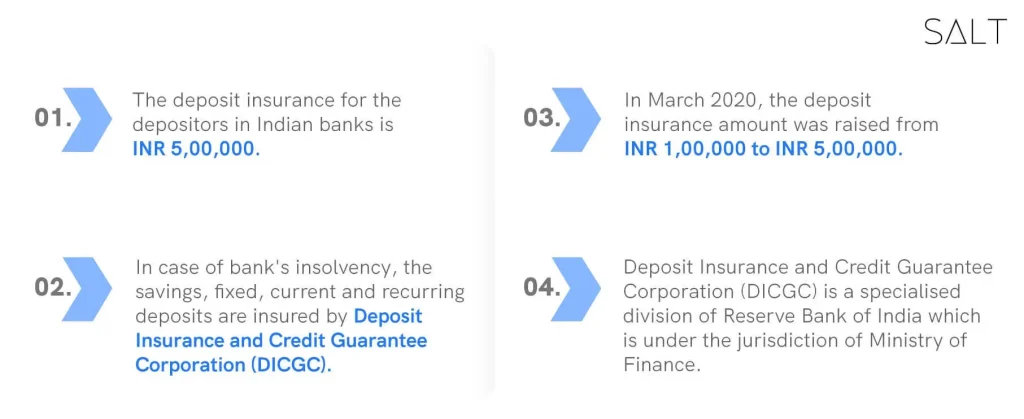

India’s bank deposit insurance, overseen by the Deposit Insurance and Credit Guarantee Corporation (DICGC), aims to safeguard depositors by providing cover for their savings in case of bank failures. Currently, the insured amount stands at ₹ 5 lakh per depositor, which, while designed to protect a significant number of small depositors, raises concerns regarding the adequacy of this coverage in an inflationary environment. Compared to other nations, India’s limit starkly contrasts with countries like Brazil and Russia, where the coverage is much higher, reflecting a more robust depositor protection system.

The importance of deposit insurance cannot be understated, as it plays a crucial role in maintaining trust in the banking system. However, for a rapidly growing economy like India, the nuances of its deposit insurance framework need a thorough review. With increasing household savings and the growing number of high-value deposits, the existing insurance limit might not sufficiently address the risks faced by larger depositors, who remain vulnerable. As the financial landscape evolves, so must the framework that protects the lifeblood of economic stability: depositors’ funds.

Challenges to Effective Depositor Protection in India

Despite the crucial role of the Reserve Bank of India (RBI) in ensuring financial stability, there exists a significant gap in depositors’ protection when compared to global standards. The current coverage limit of ₹ 5 lakh per depositor not only appears inadequate but also raises questions regarding the RBI’s commitment to fostering a secure banking environment. As India’s economy expands and banking complexities increase, the coverage limit must keep pace with the rising value of deposit accounts to effectively mitigate risks associated with banking crises.

The limitations of the existing bank deposit insurance scheme also reflect broader economic challenges within India. Many depositors still remain unaware of the nuances of deposit insurance, leading to misplaced trust in the security of their savings. Additionally, financial literacy programs must integrate discussions around deposit insurance limitations and the crucial role it plays in depositor protection. The ongoing debate about the adequacy of deposit insurance coverage should prompt a re-evaluation of policies to ensure that depositors, irrespective of their financial status, can rely on adequate protection.

Is Current RBI Deposit Insurance Coverage Enough?

The Reserve Bank of India’s (RBI) existing deposit insurance coverage has been a focal point of debate among financial analysts and economists. With countrywide efforts pushing for economic growth, the insubstantial coverage limit of ₹ 5 lakh has come under scrutiny. Many argue that this amount is inadequate when weighed against the financial aspirations of the average Indian household, particularly in urban centers where real estate and living costs outpace the current limits. The RBI’s deposit insurance could indeed be a hurdle rather than a safety net if it doesn’t evolve alongside the financial dynamics.

Moreover, considering that savings accounts, fixed deposits, and recurring deposits can quickly accumulate beyond insured limits, depositors face substantial risks in the unfortunate event of banking troubles. Enhanced coverage limits, akin to what is observed in other major economies, could elevate depositor confidence and contribute to overall financial stability in India. Reassessing the insurance coverage to enhance depositor protection will not only serve the individuals but also strengthen the foundational integrity of India’s financial sector.

Recent Changes to India’s Deposit Insurance Policies

Recent discussions surrounding India’s deposit insurance policies highlight the critical need for modernization. The RBI has been proactive in addressing some past deficiencies, recognizing that financial stability is paramount in an era where banking crises can rapidly evolve. Some initiatives have included advocating for a review of the insurance coverage amount, yet the impact of such changes remains to be seen. Policymakers must balance immediate risks with long-term strategies to ensure that deposit insurance remains relevant in a fast-changing economic landscape.

Additionally, there is a pressing need for continuous engagement with stakeholders—including banks, financial institutions, and depositors—to refine deposit insurance frameworks. Recent feedback has indicated that many depositors are unaware of the insurance limits and the implications this has on their financial security. Implementing comprehensive awareness campaigns can empower depositors, ensuring they are informed about their protections. Such measures, in conjunction with policy revisions, are essential for strengthening the overall depositor protection landscape in India.

The Role of Financial Stability in Enhancing Deposit Insurance

Financial stability serves as a backbone for a resilient banking system, and enhancing deposit insurance is a crucial aspect of this equation. A well-structured deposit insurance mechanism can mitigate risks, ensuring that fluctuations in economic performance do not lead to massive losses for depositors. The RBI’s recognition of the interplay between financial stability and deposit protection indicates a commitment to improving depositor confidence, which is essential for maintaining a healthy economic environment.

Furthermore, a robust deposit insurance framework not only protects individuals but also reinforces institutional integrity, ensuring that banks operate within a stabilized market framework. Regular assessments of the deposit insurance limits against the backdrop of economic changes can help prevent potential crises while contributing to broader financial stability. As regulatory measures continue to evolve, it will be vital for the RBI to prioritize enhancing the deposit insurance coverage to safeguard India’s economic future.

The Importance of Financial Literacy in Protecting Depositors

Promoting financial literacy is integral in ensuring that depositors understand the nuances of bank deposit insurance in India. As the landscape of personal finance becomes increasingly complex, depositors must be equipped with the knowledge to navigate their options effectively. Education initiatives can help demystify deposit insurance, informing individuals of their entitlements and the consequences of exceeding insured amounts. By fostering a culture of informed financial decision-making, depositors can better protect themselves against unforeseen banking challenges.

Incorporating financial education into the school curriculum and organizing community workshops can significantly elevate awareness about deposit insurance. This empowerment can also encourage a more engaged dialogue regarding changes to the deposit insurance framework. As depositors become advocates for their rights and necessities, this grassroots movement can compel policymakers to prioritize enhancements to India’s bank deposit insurance and other protective measures, ultimately creating a safer banking environment.

Exploring Global Standards in Deposit Insurance Coverage

Examining global standards reveals significant disparities in deposit insurance coverage, as many advanced economies offer considerably higher protections for depositors. Countries like the United States and European nations have established safety nets that exceed India’s current coverage, ensuring that depositors feel a sense of security even during periods of financial turmoil. As India positions itself as an emerging market leader, evaluating these global best practices can provide crucial insights for reforming it.

A deeper understanding of these global benchmarks allows Indian regulators to assess the effectiveness of their deposit insurance schemes critically. While international standards should guide policy development, it is also essential to tailor strategies that align with India’s unique economic and cultural context. By analyzing and learning from the success stories of other nations, India can advance towards a more comprehensive deposit insurance framework that not only aligns with global standards but also addresses local depositor needs.

The Future of Deposit Protection in India

As India steers towards economic growth and stability, the future of deposit protection appears to hinge on proactive reforms in the banking sector. Implementing increased coverage limits and ensuring widespread public knowledge about these protections is imperative. Without doubt, enhanced deposit insurance can be a cornerstone of financial stability and a major factor in maintaining confidence in the banking system. A clear roadmap about future enhancements will be essential for aligning India’s deposit insurance strategy with its growing economy.

Ongoing dialogue between the RBI, financial institutions, and the public sector will be essential to remapping the deposit insurance landscape in India. The road ahead will require a commitment from all stakeholders to prioritize depositor protection as a vital national interest. This collective effort could ultimately lead to establishing a deposit insurance scheme that not only keeps pace with economic changes but also ensures that every Indian depositor feels secure knowing their savings are protected.

Conclusion: Strengthening India’s Depositor Safety Net

In conclusion, while India’s deposit insurance scheme has provided some safety to depositors, it requires urgent and comprehensive reforms to meet the realities of the contemporary financial landscape. The existing policies, though beneficial for small depositors, leave a significant portion of the population vulnerable. A proactive approach must prioritize enhancing deposit insurance limits and ensuring that depositors have access to the knowledge required to make informed decisions about their savings.

Achieving a robust deposit insurance framework will play a critical role in fostering consumer confidence in the banking system, thereby contributing to sustained economic growth. As India continues to thrive, ensuring that depositors feel secure will not only solidify the foundation of the banking sector but also protect the interests of millions, safeguarding their financial well-being in a rapidly shifting economic environment.

Frequently Asked Questions

What is India Bank Deposit Insurance and how does it work?

India Bank Deposit Insurance is a scheme provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC) which protects depositors by insuring their bank deposits up to a limit. As per the current regulations, each depositor is insured for up to ₹ 5 lakh for both principal and interest amounts held in a bank, ensuring a safety net in case of bank failures.

What are the current RBI deposit insurance coverage limits for bank deposits in India?

The current RBI deposit insurance coverage limit for bank deposits in India is ₹ 5 lakh per depositor, per insured bank. This means that if a bank fails, the DICGC will pay depositors up to this limit, providing some level of depositor protection in the financial system.

How does the deposit insurance limit in India compare to other countries?

India’s deposit insurance limit of ₹ 5 lakh is significantly lower than many countries. For instance, Brazil offers coverage up to ₹ 42 lakh, while Russia provides up to ₹ 12 lakh, indicating that India’s deposit insurance framework does not fully safeguard large depositors, raising concerns over financial stability in India.

What impact does depositors protection in India have on financial stability?

Depositors protection in India is crucial for maintaining financial stability, as it fosters trust in the banking system. However, the current low coverage limits may leave substantial deposits unprotected, potentially undermining depositor confidence during banking crises.

What measures are in place to enhance bank deposit insurance in India?

To enhance bank deposit insurance in India, the RBI is periodically reviewing and proposing increases in coverage limits. Recent discussions highlight the need for a comprehensive reform to better align deposit insurance with international standards and inflation trends, ensuring adequate depositors protection.

Why is there a need for bank deposit insurance limits to be revisited in India?

The need to revisit bank deposit insurance limits in India arises from the increasing average household savings and the higher balance amounts in deposit accounts. As financial risks evolve and larger sums are held in banks, it is essential to ensure depositors protection keeps pace with these changes to maintain public trust.

How has India’s deposit insurance framework evolved over time?

India’s deposit insurance framework has evolved since its inception in 1961, with initial coverage limits set at a much lower amount. Over the decades, the limits have been increased, but they still remain inadequate compared to global standards, underscoring the need for ongoing reforms in the context of financial stability in India.

What is the purpose of bank deposit insurance in maintaining financial stability in India?

The purpose of bank deposit insurance in maintaining financial stability in India is to protect depositors’ funds, preventing bank runs during periods of financial uncertainty. By ensuring that deposits are insured, the scheme aims to sustain confidence in the banking system, which is vital for a robust economy.

What challenges does India face regarding deposit insurers and financial stability?

India faces several challenges regarding deposit insurers, primarily the low coverage limits which may not adequately protect depositors during banking crises. Additionally, a lack of awareness about deposit insurance among the public further complicates the situation, highlighting the need for improved communication and policy adjustments fostering depositors protection.

| Key Point | Details |

|---|---|

| Current Status | India’s deposit insurance coverage is low compared to global standards. |

| Comparison with Other BRICS Countries | Deposit insurance coverage is ₹ 42 lakh in Brazil and ₹ 12 lakh in Russia, indicating India’s lag. |

| Household Savings | Rising household savings question the adequacy of the RBI’s safety net. |

| Depositor Protection Gaps | The insurance scheme covers many accounts but does not sufficiently protect high-value depositors. |

| Implementation Issues | Although the concept of deposit insurance is valuable, its execution in India is lacking. |

| Policy Impact | Recent measures to address issues are seen as reactive rather than proactive. |

Summary

India Bank Deposit Insurance plays a crucial role in safeguarding depositors’ funds, yet the current coverage is not adequate to fully protect large depositors. With significant contrasts when compared to other BRICS nations, this raises concerns about the overall effectiveness of the scheme. As household savings rise, it is essential for the Reserve Bank of India to reassess and bolster the deposit insurance framework to ensure that it serves its intended purpose effectively, maintaining public trust and financial stability.