Conservative tax cuts are at the forefront of the Conservative Party Canada’s economic strategy, promising a substantial $70 billion reduction in taxes amidst an ambitious plan for new government spending, detailed in the latest Canada budget 2025. This financial framework is spearheaded by Pierre Poilievre, who has asserted that these tax reductions are vital for stimulating the economy and benefiting Canadian families. By prioritizing tax cuts over a balanced budget in his platform, Poilievre aims to reshape the fiscal landscape while facing scrutiny from opposing parties. Critics question the feasibility of such tax reduction plans given the projected $100 billion in deficits during his first term, raising concerns about long-term implications for government spending proposals. Nevertheless, the Conservative tax cuts remain a cornerstone of Poilievre’s vision, promising to transform the economic conditions for Canadians.

The latest proposal from the Conservative Party of Canada underscores the party’s commitment to fiscal conservatism through its substantial tax relief initiatives. With plans for sweeping alterations in financial policy, the party, led by Pierre Poilievre, aims to reshape Canada’s economic future by cutting taxes significantly, while also increasing government investments. The Conservatives stress the importance of reducing the burden on taxpayers as part of their broader economic agenda, setting the stage for a debate on the sustainability of such financial strategies amid growing national deficits. This thrust towards lower taxation and streamlined governance echoes broader discussions about government spending priorities and long-term economic viability. As election discussions unfold, the implications of these tax policies will dominate conversations surrounding the upcoming Canada budget 2025.

Understanding Conservative Tax Cuts in the Canada Budget 2025

The Conservative Party of Canada, led by Pierre Poilievre, is making bold promises in the lead-up to the 2025 budget, including a significant commitment to over $70 billion in tax cuts. These tax reduction plans aim to alleviate the financial burden on Canadians while also promoting economic growth. By positioning tax cuts as a means to stimulate consumer spending and investment, the Conservatives hope to elevate their appeal among voters who are wary of increasing government spending and fiscal deficits.

The proposal to implement these Conservative tax cuts comes amid projected deficits that could reach $100 billion over Poilievre’s first term. Despite the emphasis on fiscal responsibility, this heavy spending combined with reduced tax revenues raises questions about the sustainability of the government’s financial plans. Critics argue that such tax reductions could lead to further budgetary challenges, potentially undermining the fundamental goal of achieving a balanced budget.

The Conservative Party of Canada’s Spending Proposals

Alongside their ambitious tax cuts, the Conservative Party’s budget plan includes $34 billion in new spending initiatives. These investments are framed as necessary to address key issues such as housing affordability, crime reduction, and economic growth. For instance, a proposed $150 million ‘Keep Canadians Working Fund’ aims to sustain job levels amidst a challenging economic environment, showcasing the party’s commitment to workforce stability even while advocating for lower taxes.

Furthermore, the Conservatives have pledged to tackle inefficiencies by streamlining government operations, which they believe will reduce wasteful spending. Such measures are crucial as Canadians are increasingly aware of the government’s financial stewardship, particularly in light of the opposition’s critique of the projected deficits and their potential impact on future generations. The Conservatives’ approach highlights the tension between tax cuts and increased government spending, laying the groundwork for a heated debate during the election campaign.

Pierre Poilievre’s Economic Vision and Critiques

Pierre Poilievre’s economic platform is centered around creating a competitive landscape for Canadian businesses while simplifying the tax code and cutting through bureaucratic red tape. He proposes significant changes, including the repeal of various regulations imposed by the previous Liberal government, which he claims restrict economic activity. This approach resonates with many Canadians who feel that government intervention has stifled growth prospects in recent years.

However, Poilievre’s proposals have faced scrutiny from various opposition leaders who argue that his forecasts are overly optimistic. Critics like Liberal Leader Mark Carney and NDP Leader Jagmeet Singh contend that the Conservative math does not add up and that the promised tax cuts may jeopardize essential government services. This debate is vital for voters to consider as they assess the feasibility of the Conservative platform against their everyday economic realities.

Economic Impact of a Balanced Budget: Conservative Perspectives

While Pierre Poilievre’s Conservatives have avoided committing to a balanced budget within their first term, they maintain that a gradual reduction of the deficit is still critical for economic health. By investing heavily in tax cuts and government spending, they believe they can foster an environment conducive to job creation and economic regeneration. The party emphasizes that a well-planned approach to balancing the budget can still occur, albeit socially and economically challenged by immediate tax reforms.

The Conservatives argue that by leveraging projected tariff revenues of approximately $20 billion linked to the ongoing trade dynamics, they can offset some of the anticipated deficits. This stance acknowledges the delicate balance between fiscal responsibility and the urgent needs of Canadian citizens, particularly in light of current challenges posed by international trade relations. The focus on deriving new revenues is crucial, as it forms a cornerstone of Poilievre’s strategy.

The Role of Tariffs in Conservative Government Revenue

In this election cycle, the Conservatives highlight the role of tariffs as a vital source of revenue, particularly in response to the trade war instigated by the United States. With an estimated $20 billion expected from tariffs, Poilievre’s team argues that these funds will be redirected towards tax cuts and direct support for Canadians, establishing a clear link between trade policy and fiscal strategy. This promise not only positions the Conservatives as protectors of Canadian interests but also emphasizes their preference for aggressive trade measures that can yield domestic benefits.

Critics, however, express skepticism regarding the sustainability of relying on such revenues. Questions remain about whether projected tariff earnings can consistently be counted on, given fluctuating international relations and trade negotiations. The Conservatives’ economic platform must address these criticisms while reassuring voters that their financial plans are grounded in realistic and achievable outcomes.

Impact on Housing: Conservative Proposals for Affordable Living

The Conservative Party’s strategy includes a multi-faceted approach to tackle the pressing issue of housing affordability in Canada. By committing to remove taxes and streamline bureaucracy around housing development, Poilievre aims to foster faster construction and lower housing costs for Canadians. These measures are designed to attract both private investment and new home buyers by ensuring that housing remains within reach for average families.

However, whether these proposals can effectively mitigate the housing crisis remains to be seen, especially given the broader economic context. Critics argue that without adequately addressing zoning laws and other structural barriers, simply reducing taxes won’t yield the desired effect on housing prices. The Conservatives must emphasize a comprehensive strategy that acknowledges market dynamics and potential challenges facing new developments.

Defending Against Opposition: Conservative Responses

The Conservative platform has prompted robust pushback from opposition parties, who are quick to challenge the feasibility of Poilievre’s ambitious tax cuts and spending initiatives. In particular, Liberal Leader Mark Carney has labeled the Conservative projections as unrealistic in the face of a historic trade war, claiming that a lack of tangible plans to address these challenges reflects poorly on Poilievre’s economic acumen. Such critiques play a crucial role in shaping public perceptions as Canadians weigh their voting options.

Poilievre’s response strategy revolves around framing the Conservatives as the only party capable of delivering real fiscal reform, arguing that current government spending patterns will lead to unsustainable debt levels. By painting the opposition as having failed to address these issues soundly, the Conservatives aim to rally support from constituents who prioritize financial accountability and sustainable governance.

Streamlining Government: A Conservative Agenda

A central element of the Conservative Party’s economic platform is the promise to streamline government operations and reduce bureaucratic inefficiencies. This includes plans to cut back on public servant hires and amend educational requirements for certain public service positions. The Conservatives argue that these changes will enhance productivity within the civil service while redirecting resources towards more critical areas such as healthcare and infrastructure.

While this approach seeks to reduce government spending, it has attracted criticism regarding its potential long-term impacts on public service quality. Opponents argue that such sweeping changes could undermine the effectiveness of government functions and lead to increased workloads for remaining employees. Thus, this proposal is likely to be scrutinized in the lead-up to the election as voters consider all aspects of government efficiency.

A Future with Conservative Fiscal Policies: What to Expect

The Conservative Party’s proposals set the stage for a potential shift in Canada’s fiscal policy landscape. With promises of significant tax cuts and a commitment to maintain government expenditures, Poilievre is envisioning an economic revival that prioritizes individual financial freedom and less government intervention. However, realizing these goals while managing deficits and public expectations will be a significant challenge for any new Conservative government.

As the election approaches, Canadians will need to critically assess the Conservative platform against not only the promises of lower taxes but also the potential social and economic ramifications of increased deficits. Poilievre’s assertions that these changes will lead to an overall boost in revenue and economic growth will be under close examination from voters and experts alike. The path forward involves balancing ambitious fiscal plans with the realities of governance and economic stability.

Frequently Asked Questions

What are the proposed tax cuts in the Conservative Party of Canada’s 2025 budget?

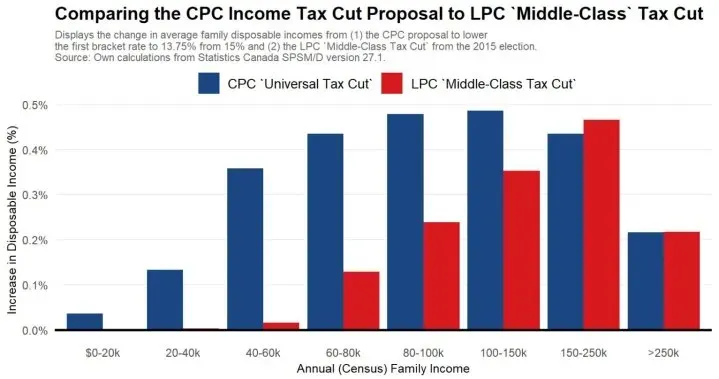

The Conservative Party of Canada has proposed over $70 billion in tax cuts as part of their platform for the 2025 budget. These tax reductions are aimed at providing financial relief to Canadians while also fostering economic growth. Specifics include a plan to lower the personal income tax rate from 15% to 12.75% over three years, beginning in 2026.

How will Pierre Poilievre’s Conservative tax cuts impact government revenues?

Pierre Poilievre’s Conservative tax cuts are projected to influence government revenues significantly. The plan anticipates generating approximately $72 billion over four years by repealing certain laws and taxes, thus boosting the economy. In particular, the elimination of carbon taxes and the repeal of specific regulations are expected to contribute positively to revenue streams.

What is the Conservative Party’s stance on balancing the budget with their proposed tax cuts?

The Conservative Party, under Pierre Poilievre, has not committed to balancing the budget within the first term of government due to the substantial tax cuts and $34 billion in new spending outlined in their platform. They project running approximately $100 billion in deficits during their first term.

How does the Conservative tax reduction plan propose to fund new spending?

The Conservative tax reduction plan outlines that a significant portion of their proposed new spending will be financed through projected revenues from tariffs, estimated to reach $20 billion this year. Additionally, they plan to optimize government spending by eliminating waste, bureaucracy, and excessive foreign aid.

What are some criticisms of the Conservative tax cuts proposed by Pierre Poilievre?

Critics, including opposition leaders, have described the financial projections related to Pierre Poilievre’s tax cuts as unrealistic. For instance, Liberal Leader Mark Carney and NDP Leader Jagmeet Singh have both raised concerns about the feasibility of the proposed tax reductions and the associated economic forecasts, suggesting they lack sound basis and ignore the current economic challenges, such as the trade war with the U.S.

When will tax cuts from the Conservative platform come into effect?

The tax cuts proposed in Pierre Poilievre’s platform, including the reduction of the lowest personal income tax rate, are set to be implemented incrementally, with the first reduction starting in the 2026 tax year. By the 2028 tax year, the bulk of these tax cuts will take effect.

What is meant by the Conservatives’ plan to involve voters in new tax proposals?

The Conservative Party has committed to holding a referendum for voter approval on any new taxes or increases to existing taxes. This approach is part of their broader strategy to ensure that tax policies align with the views and desires of Canadians.

What are the broader implications of Pierre Poilievre’s Conservative budget proposals?

Pierre Poilievre’s Conservative budget proposals aim to reshape Canada’s economic landscape. By implementing significant tax cuts and reducing government expenditures, the Conservatives assert that their approach will stimulate economic growth and promote fiscal responsibility. However, these plans have generated controversy regarding long-term fiscal sustainability and potential impacts on social programs.

How do tariffs factor into the Conservative tax reduction plans for 2025?

Tariffs play a crucial role in the Conservative tax reduction plans for 2025. The Conservatives project $20 billion in tariff revenues, primarily resulting from Canada’s response to U.S. trade policies. They have pledged to return this revenue to Canadians either in the form of direct support or through additional tax cuts, claiming that no portion will be redirected to other government expenditures.

What elements are included in the Conservative Party’s broader government spending proposal?

The Conservative Party’s government spending proposal amounts to $34 billion over the next few years. It includes commitments to reduce bureaucracy, streamline public services, and invest in housing development. This approach is intended to complement their tax cuts and stimulate economic activity across Canada.

| Key Components | Details |

|---|---|

| Tax Cuts | Over $70 billion in tax reductions proposed by the Conservatives by 2028-29. |

| New Spending | $34 billion in new government expenditures projected. |

| Annual Deficits | Deficits projected for 2025-26: $31 billion; 2026-27: $31 billion; 2027-28: $23 billion; 2028-29: $15 billion. |

| Tariff Revenue | $20 billion expected from tariffs due to trade tensions with the U.S. to fund tax cuts and direct support. |

| Revenues from Tax Cuts | Projected new revenue of $72 billion over four years due to repealing existing laws and regulations. |

| Federal Spending Plans | Liberals projected $130 billion new spending without balancing the budget, contrasted with Conservative plans. |

| Criminal Justice Reform | Commitment to the most significant crackdown on crime with three strikes law and changes to the bail system. |

Summary

Conservative tax cuts are a significant element of Pierre Poilievre’s economic platform, promising over $70 billion in reductions alongside substantial government spending. While the plans seek to lower taxes and reduce bureaucracy, they lack a commitment to achieving a balanced budget in the near term, resulting in projected deficits totaling $100 billion. This strategy has sparked criticism from opponents who argue that the proposed revenue generation methods are unrealistic, questioning the efficacy of such tax cuts in the current economic climate.