Understanding the impact of the Sebi rule overnight funds NAV is essential for anyone involved in mutual fund investments. Effective June 1, 2025, the Securities and Exchange Board of India (Sebi) is updating its regulations regarding how net asset value (NAV) is calculated for overnight mutual funds. This rule not only alters cut-off times for NAV determination but also aims to enhance the protection and security of investor interests. With 34 active overnight mutual fund schemes currently, amounting to a substantial asset value of ₹ 62,458 crores, these changes can significantly influence investment strategies in the market. Staying informed about these Sebi regulations and the details surrounding NAV calculation will be crucial for investors seeking profitable opportunities in overnight funds.

The upcoming changes in the calculation of the net asset value of overnight investment schemes, set to be enforced on June 1, 2025, are pivotal for investors navigating the mutual fund landscape. Known as overnight funds, these investment vehicles offer an opportunity to earn returns over a very short duration, typically just one day. As per the new Sebi guidelines, the revised cut-off timings for applications play a crucial role in determining which NAV will apply to redemptions and purchases. This shift reflects a broader effort by the regulatory body to ensure a clear framework for the mutual fund industry, alongside maintaining investor confidence. Understanding these alternate terminologies and their implications will equip investors to make informed decisions regarding their overnight mutual fund portfolios.

Understanding Sebi’s New Rule on NAV for Overnight Funds

Sebi’s recent initiative to revise the cut-off timings for determining the net asset value (NAV) of overnight funds marks a significant milestone in mutual fund management in India. Effective June 1, 2025, these changes aim to streamline the process for investors seeking liquidity from their overnight mutual fund investments. The new regulations stipulate that applications received by 3 PM will utilize the previous day’s closing NAV, while those received post-3 PM will leverage the next business day’s closing NAV. This structure is designed to enhance the predictability of returns for investors by ensuring they are aware of which NAV they will be receiving based on their transaction time.

In addition to the cut-off times, Sebi also implemented a provision for online applications, adjusting the cut-off to 7 PM to further accommodate investor preferences. This revision acknowledges the growing trend of digital transactions among investors and is expected to encourage more participation in overnight fund schemes. The changes come on the back of Sebi’s circular issued on December 12, 2023, which aimed at protecting investor interests and enhancing operational efficiencies in the market.

Impact of Sebi Regulations on Investors in Overnight Mutual Funds

The impact of Sebi’s revised cut-off timings on investors is multifaceted. By altering the NAV calculation structure for overnight mutual fund schemes, Sebi is reinforcing its commitment to investor transparency and accountability within the securities market. For existing and potential investors, this means that the ability to manage liquidity will become more strategic, as accessing funds becomes aligned with a clear timetable. As there are now 34 overnight mutual fund schemes managing assets totaling ₹ 62,458 crores, the implications for mutual fund investments are substantial, making it essential for investors to understand these changes fully.

Importantly, this rule is also designed to protect investor interests by ensuring that their funds are utilized efficiently within the market parameters. With consistent regulation from Sebi, the growth and stability of mutual fund products can be expected to amplify, ultimately benefiting investors in the long run. Furthermore, as Sebi continues to assess and adapt regulations, it positions itself as a forward-thinking entity dedicated to enhancing the overall health of India’s mutual fund industry.

The Role of NAV Calculation in Steering Overnight Fund Investments

NAV calculation plays a pivotal role in how overnight mutual funds operate, influencing everything from investor decisions to market pricing. The methodology behind NAV calculation impacts the performance metrics communicated to potential investors and defines the transparency of the fund’s management. By establishing specific cut-off times for these calculations, Sebi ensures that investors have confidence in the pricing of their investments. The new rules clarify when the NAV will be applied, thus fostering an environment where strategic investment decisions can be made with certainty.

Moreover, the structure of NAV calculation as enforced by Sebi reflects the broader regulatory framework shaping mutual fund investments in India. As investors look to engage with overnight funds, it’s essential to grasp how these regulations align with overall market stability and individual financial goals. Understanding the nuances of NAV calculations can empower investors to navigate their portfolios more effectively and identify the most advantageous times to execute their investments.

Sebi Circular’s Potential Influence on Overnight Mutual Fund Schemes

The Sebi circular released on April 22 underlines the regulatory body’s ongoing effort to refine and improve the mutual fund industry landscape in India. As the circular goes into effect on June 1, 2025, it is set to redefine the operational procedures for overnight mutual fund schemes. This is particularly relevant for investors who are keen to leverage these products for short-term financial engagements. By addressing the timing of NAV calculations, Sebi is establishing a framework that seeks to enhance clarity and promote investor trust in overnight funds.

Furthermore, the implications of the Sebi circular extend beyond just the operational aspects of fund management. It signifies deeper engagement with market participants, verifying that their collective inputs and challenges are considered in the regulatory process. As regulatory adaptations unfold, the performance of overnight schemes is expected to align more closely with market dynamics and investor needs. This responsiveness to market conditions is vital in ensuring the sustained health of the mutual fund industry.

Exploring the Benefits of Overnight Mutual Funds Post-Sebi Regulations

With the impending changes set to roll out in June 2025, the benefits of investing in overnight mutual funds are becoming more pronounced. These funds, known for their short maturation period of just one day, allow investors to maintain liquidity while still earning returns associated with mutual fund investments. Sebi’s move to amend NAV cut-off timings is likely to encourage more investors to consider overnight funds as a reliable investment alternative, especially during volatile financial periods where quick access to funds is crucial.

Moreover, the ability to leverage online applications for transactions until 7 PM aligns with modern investor behavior, likely increasing participation within these schemes. Investors will benefit from a more flexible investment model, as they can adapt their actions based on the revised cut-off times. This adaptability is especially appealing for those seeking quick turnaround investments without sacrificing potential gains. Ultimately, the new regulations by Sebi stand to enhance the attractiveness of overnight mutual funds in India.

Navigating Mutual Fund Investments under the New Sebi Guidelines

Navigating the landscape of mutual fund investments in light of the new Sebi guidelines requires a strategic approach and awareness of the changes being implemented. Investors must familiarize themselves with the specifics of the revised cut-off times for NAV calculations, which will undoubtedly impact their investment strategies. Understanding these guiding principles will provide investors with a competitive edge when engaging in overnight mutual funds, especially amidst the fluctuating market conditions.

Moreover, adherence to Sebi’s regulations not only arms investors with necessary knowledge but also instills confidence in the integrity of the market. As these guidelines come into full effect, it is paramount for investors to stay engaged and informed about their investments in overnight mutual funds. By being proactive, investors can better align their financial goals with the newly established NAV structures, leading to a more fruitful investment journey.

Sebi’s Role in Regulating Overnight Fund NAV Changes

The Securities and Exchange Board of India plays a crucial role in regulating the financial markets, and the upcoming changes to overnight fund NAVs reflect its commitment to enhancing market dynamics. By introducing regulations that affect cut-off timings, Sebi is not only safeguarding investor interests but also fortifying the operational scaffolding of the mutual fund industry. This proactive approach signals to market participants that the regulator is aware of the evolving landscape and is willing to adapt rules to ensure transparency and accountability.

Through the enforcement of these new NAV calculation standards, Sebi aims to address the complexities faced by mutual fund managers and investors alike. Cleary defined cut-off times will assist in demystifying the process of fund redemption and repurchase, making it accessible for all participants, from retail to institutional investors. Overall, Sebi’s active role in shaping regulatory frameworks not only benefits individual investors but also boosts the confidence and growth of the entire mutual fund sector.

The Interplay Between Overnight Mutual Funds and Market Stability

The relationship between overnight mutual funds and market stability is significant, especially amid the implementation of Sebi’s new regulations. Overnight funds often play a critical role in generating liquidity in the financial markets, acting as short-term investment vehicles for managing cash surplus. The evolution of NAV calculation processes under Sebi’s directives is poised to further promote this stability, allowing investors to make well-informed decisions that bolster market confidence.

Furthermore, by making these adjustments to cut-off timings, Sebi enables smoother transitions for fund repurchase and redemption, ultimately contributing to a more stable financial ecosystem. The predictability in NAV application provides investors with a clearer view of their investments, reducing uncertainty in a notoriously volatile market. As Sebi continues to refine its policies, the interplay between mutual fund regulations and overall market stability will undoubtedly continue to evolve.

Analyzing the Investor Protections Afforded by Sebi’s Circular

The Sebi circular introduced in April represents a robust framework for protecting investors in the overnight mutual fund space. With regulations focused on the timing of NAV calculations, the circular offers clarity that is crucial for investor confidence. The adjustments predetermined in the circular will directly impact how investors perceive risk and return, thereby fostering a more reliable investment environment.

Moreover, investor protection extends beyond just NAV considerations; it encompasses the broader regulatory vision that Sebi champions. By consistently updating and refining these regulations, Sebi ensures that investors can navigate mutual fund investments with greater assurance, ultimately leading to a more solidified trust in the mutual fund industry. The proactive stance taken by the regulator aims to not only attract new investors but also retain existing ones in an ever-evolving market.

Future Prospects of Overnight Funds in Light of Regulatory Changes

Looking ahead, the future prospects of overnight funds in India seem promising with the implementation of Sebi’s new regulations coming into play. The expected modifications to NAV calculation and cut-off timings present an opportunity for these funds to capture a more significant share of the investment market. Since overnight funds offer a blend of liquidity and yield, the revised regulations could very well elevate their appeal among risk-averse investors seeking stable options.

As regulatory frameworks continue to evolve, the adaptability of overnight fund schemes in response to market needs will be key. Investors can expect more innovations and enhancements in fund management practices as Sebi’s policies take root. This positions overnight mutual funds not just as vehicles for short-term investments, but as integral components of a well-diversified investment strategy moving forward.

Frequently Asked Questions

What are the key changes in Sebi’s rules regarding overnight funds NAV effective June 1, 2025?

Sebi’s rules regarding overnight funds NAV will implement new cut-off timings for NAV calculation. If an application is received by 3 PM, the closing NAV of the previous business day will apply; if received after 3 PM, the subsequent business day’s NAV will apply. Additionally, for online applications, a 7 PM cut-off time is established.

How does the NAV calculation for overnight mutual funds differ under the new Sebi regulations?

Under the new Sebi regulations, the NAV calculation for overnight mutual funds will reflect different cut-off timings. Applications received by 3 PM will utilize the closing NAV of the previous day, while those after 3 PM will use the NAV of the next business day. This aims to enhance the efficiency of mutual fund investments.

What is the significance of the Sebi circular released on April 22 related to overnight funds NAV?

The Sebi circular released on April 22 outlines crucial changes to the NAV calculation for overnight funds, emphasizing investor protection and efficiency in fund management. These regulations, effective June 1, 2025, aim to streamline the repurchase and redemption processes of mutual fund investments.

How do the new cut-off times affect investors in overnight mutual fund schemes?

Investors in overnight mutual fund schemes will experience changes in how their repurchase and redemption amounts are calculated based on the new cut-off times. These changes are designed to optimize the NAV calculation, providing clearer guidance on when their investments will be valued.

Are there any exceptions to the cut-off timings for calculating overnight funds NAV as per Sebi’s rules?

Yes, the Sebi rules specify that business days do not include times when money markets are closed, meaning if applications are submitted on such days, the NAV calculation will not apply until the next accessible business day.

What prompted the changes in the Nav calculation for overnight mutual funds by Sebi?

The changes in NAV calculation for overnight mutual funds were prompted by recommendations from a working group of industry stakeholders, aimed at enhancing the efficiency of fund operations and ensuring the protection of investor interests as per Sebi’s continuous regulatory efforts.

How many overnight mutual fund schemes are currently operating under Sebi regulations?

As of now, there are 34 overnight mutual fund schemes regulated by Sebi, with a total asset value of ₹ 62,458 crores, reflecting the growing interest and safety measures surrounding overnight mutual fund investments.

What measures is Sebi taking to protect investors in the context of overnight funds?

Sebi is implementing stricter cut-off timings and enhancing NAV calculation methodologies to ensure transparent and efficient transactions in overnight funds, thereby protecting investor interests while promoting a more robust securities market.

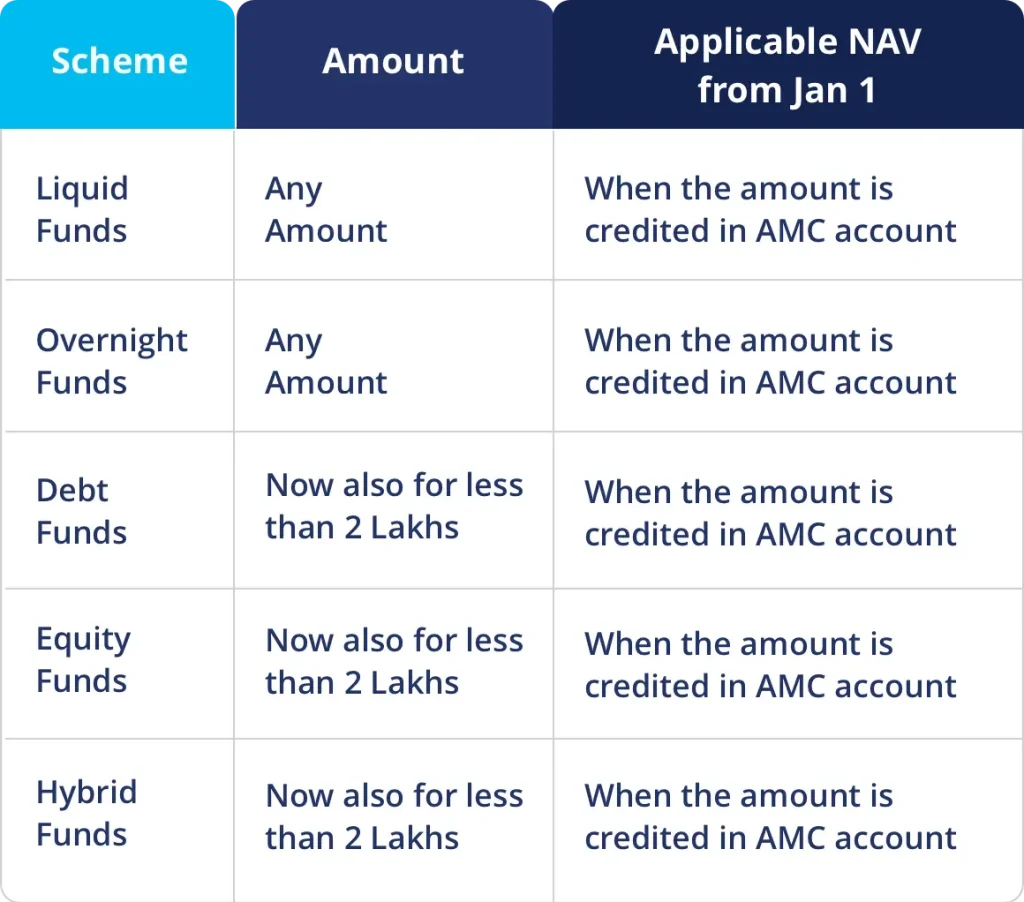

| Cut-off Timing | Applicable NAV |

|---|---|

| If application is received by 3 PM | Closing NAV of the day immediately preceding the next business day |

| If application is received after 3 PM | Closing NAV of the next business day |

| For applications received online (cut-off at 7 PM) | Applicable NAV follows the 7 PM cut-off |

| Exemptions | Business days exclude inaccessible money market days |

Summary

Sebi’s rule regarding overnight funds NAV is set to enhance investor protection and streamline processes starting June 1, 2025. The revamped cut-off timings aim to establish a clearer framework for the calculation of net asset values of overnight mutual funds. These changes will ensure that investors can effectively manage their investments with greater foresight and alignment to market operations.