Managing your investments effectively is essential, and the Axis Direct capital gains statement is a crucial tool for any investor. This document not only simplifies your Income Tax Return (ITR) filing process but also provides a clear view of your financial performance for the year. Whether you’re looking to download your capital gains statement for accurate record-keeping or explore your Axis Direct portfolio management options, having this report is vital. It offers detailed insights into your gains and losses, assisting you in making informed investment decisions. As the tax filing deadline approaches, ensure you have your capital gains report 2025 ready to facilitate a smooth submission.

In the realm of financial reporting, the capital gain summary from Axis Direct serves as an invaluable resource for investors. It’s often referred to as a tax report or investment performance document, essential for streamlining the ITR documents for filing. By analyzing this comprehensive output, investors can assess their financial standing, thus aiding in effective portfolio management. The process of obtaining your capital gain report can be completed quickly via their web portal or mobile app, ensuring you remain compliant with tax regulations. Having timely access to these detailed statements can significantly enhance your investment strategy and tax obligations.

How to Download Your Axis Direct Capital Gains Statement Easily

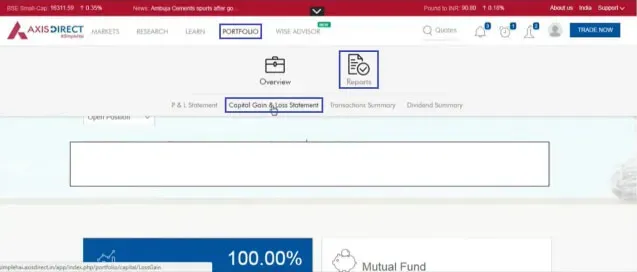

To download your Axis Direct capital gains statement, simply visit their official web portal or mobile application. The process begins with logging into your account, where you can navigate to the ‘My Portfolio’ section. From there, you can find reports related to your investments, which include the important capital gain and loss statement. This document is vital for accurate reporting of your financial activities, as it outlines your short-term and long-term capital gains. Make sure to select the appropriate financial year to ensure the statement is relevant for your current ITR filing.

Once you access your capital gains statement through the Axis Direct portal, you can opt to download it in PDF or Excel format. This is especially useful for creating your **Income Tax Return (ITR)** documents for filing, as it allows for easy integration of data into your tax forms. Keep in mind that having the capital gains report 2025 ready helps streamline the filing process, making it essential to familiarize yourself with the downloading steps as tax deadlines approach.

Using the Axis Direct Mobile App for Capital Gains Statement Access

For those who prefer mobile accessibility, the Axis Direct app offers a convenient way to download your capital gains statement directly from your smartphone. After downloading the app from either the Google Play Store or the Apple App Store, logging in to your account is straightforward. Navigate to the ‘Portfolio’ section and then proceed to ‘Reports’ to find your capital gain and loss statement. This mobile method saves time and ensures that investors can manage their portfolio on-the-go.

The Axis Direct mobile app mirrors functionalities available on the web portal, allowing users to customize date ranges and download their capital gains statement efficiently. By having this flexibility, you can maintain a close watch on your investments, which is crucial for effective tax planning and portfolio management. Whether you are reviewing your gains or preparing for ITR filing, the mobile app provides an essential tool for managing your financial data effortlessly.

Understanding the Significance of the Capital Gains Statement

The **capital gains statement** is critical for anyone engaged in equity trading or mutual fund investments. It summarizes the gains and losses realized during a financial year, which directly influences your tax liability. By breaking down your investments into short-term and long-term categories, this statement ensures you comply with tax regulations while maximizing your tax efficiency. During the ITR filing season, these details become indispensable for accurately reporting income.

Having access to a detailed capital gains report allows taxpayers to prepare more effectively, responding to potential audits with clarity and confidence. Furthermore, keeping track of dividends, investments, and losses provides a comprehensive view of your financial health, essential for informed decision-making in portfolio management. By utilizing Axis Direct’s resources, investors can not only streamline their ITR documentation but also gain insights into their investment strategies.

The Role of Capital Gains Report in ITR Filing

Your **capital gains report 2025** is an essential document that supports the accurate completion of your Income Tax Return (ITR). It breaks down the gains and losses you’ve incurred, which are crucial components in calculating your taxable income. For taxpayers, it’s important to collect all relevant documents in a timely manner to prevent missing the filing deadline. The ITR documents for filing are not solely based on salary and employment; they also include these vital investment insights.

To facilitate a smooth ITR filing experience, investors should ensure their capital gains report is detailed and readily accessible before they begin the process of filling out their tax returns. Missing elements or uncertainties in the capital gains figures can lead to complications or inaccuracies in tax calculations, making the entire experience stressful. Therefore, obtaining your capital gains statement promptly can lead to a more organized and efficient ITR filing.

Steps to Ensure a Smooth Capital Gains Download

To ensure a successful download of your Axis Direct capital gains statement, you need to follow systematic steps. Start by navigating to the ‘Reports’ section of your Axis Direct account, whether on the web portal or via the mobile app. This involves selecting the correct financial year and confirming your selections before proceeding to download the statement. Always double-check the downloaded file to ensure it contains the data you need, as this will aid in your accurate ITR filing.

Additionally, if you encounter any issues during the downloading process, Axis Direct provides several support channels to assist users. It’s crucial to keep track of your document downloads, especially as deadlines approach, ensuring that you have every piece of information required for effective tax compliance. Organized financial records not only simplify completing your ITR but also provide a clear overview of your investment performance throughout the financial year.

Maximizing Portfolio Management with Axis Direct

Effective portfolio management is paramount for investors looking to maximize their returns. The Axis Direct platform offers tools that allow you to view and manage your investments effectively. With access to a consolidated year-end statement and detailed capital gains summaries, you can make informed decisions about future investments. Such insights are instrumental when planning your financial strategy for the upcoming year, ensuring you optimize your portfolio’s performance.

Moreover, understanding your profits and losses can assist in the strategic rebalance of your portfolio. By analyzing capital gains summaries, you can identify which investments yield the best returns and which require reevaluation. With Axis Direct, investors have the opportunity to not only track their performance but also improve their understanding of market trends, which is fundamental for sophisticated investment strategies.

The Importance of Timely Access to Your Statements

Timely access to your capital gains statement is crucial for effective financial management, especially when tax deadlines loom. With the ITR filing deadline approaching on July 31, 2025, securing all pertinent documentation early can alleviate last-minute scrambles. Ensuring you have your capital gains statement and other related investment documents at hand will simplify the tax preparation process significantly.

Moreover, acquiring your documents well in advance allows you to review potential discrepancies or unclear entries. This proactive approach enables you to address any inaccuracies with your broker or bank before beginning your ITR filing. With the right preparation, you can ensure compliance with tax regulations while also maximizing your returns from various investments.

Essential Documents for ITR Filing Beyond Capital Gains

While the capital gains statement is a cornerstone of your ITR filing, it isn’t the only document you need to prepare. Essential items include interest certificates from banks, Form 16, and salary slips from your employer. All of these elements together create a comprehensive financial profile that is essential for accurate reporting of your income and deductions. The more organized you are in gathering these documents, the smoother your ITR process will be.

Additionally, keeping track of all these essential ITR documents helps during potential audits from tax authorities. By maintaining a clear record of your income, expenses, and capital gains, you protect yourself against possible disputes with tax officials. Ensuring every document is in order not only aids in present tax filing but also prepares you for any future tax-related scrutiny.

Navigating Customer Support for Axis Direct Users

If you encounter any hurdles during the download process or need clarification on your capital gains statement, Axis Direct offers robust customer support. Users can reach out to the support team via the contact details provided on their official website. Guidance on typical issues like downloading statements or understanding reports can streamline your experience considerably.

Moreover, familiarizing yourself with the Axis Direct help resources can provide insights into common queries surrounding ITR filing and capital gains reports. Quick responses and efficient problem resolution will enhance your overall experience, allowing you to stay focused on managing your investments without unnecessary distractions.

Frequently Asked Questions

How can I download my Axis Direct capital gains statement for accurate ITR filing?

To download your Axis Direct capital gains statement for accurate ITR filing, log in to your Axis Direct account on their official website. Go to the ‘My Portfolio’ section, select ‘Reports’, and click on ‘Capital Gain & Loss Statement’. Choose the relevant financial year or enter a custom date range, then click ‘Download’ to save your statement.

What is the process to obtain my Axis Direct capital gains report for 2025 from the mobile app?

To obtain your Axis Direct capital gains report for 2025 via the mobile app, first, download the Axis Direct app from the Google Play Store or Apple App Store. Log in, go to the ‘Portfolio’ section, select ‘Reports’, and then ‘Capital Gain & Loss Statement’. Choose your desired financial year and tap ‘Download’ to save the report.

Why is the Axis Direct capital gains statement important for ITR filing?

The Axis Direct capital gains statement is crucial for ITR filing as it accurately reports your gains and losses from investments in mutual funds, equities, and derivatives. It helps in providing a clear picture of your financial activities, ensuring compliance and transparency during tax filings.

Can I access my Axis Direct capital gains statement for portfolio management?

Yes, accessing your Axis Direct capital gains statement aids in effective portfolio management. It details your short-term and long-term gains and losses, allowing you to make informed investment decisions while tracking your overall financial performance.

What documents do I need besides the Axis Direct capital gains statement for ITR filing?

In addition to your Axis Direct capital gains statement, you will need documents such as interest certificates from banks, salary slips from employers, Form 16, and loss carry statements to ensure a comprehensive and accurate ITR filing.

What financial details are included in the Axis Direct capital gains report for 2025?

The Axis Direct capital gains report for 2025 includes detailed breakdowns of short-term and long-term gains and losses, indexed and non-indexed values, and a summary of total dividends earned, which are essential for tax calculations and investment analysis.

How do I contact Axis Direct support for issues related to my capital gains statement?

To contact Axis Direct support for any issues regarding your capital gains statement, visit their official website to find customer service options, including phone support and live chat, ensuring you receive timely assistance.

| Key Points | Details |

|---|---|

| Downloading Axis Direct Capital Gains Statement | Available through the Axis Direct web portal and mobile app. |

| Importance | Essential for accurate ITR filing and portfolio management. |

| Accessing via Web Portal | Log in, go to ‘My Portfolio’, select ‘Reports’, then ‘Capital Gain & Loss Statement’ to download. |

| Accessing via Mobile App | Log in, navigate to ‘Portfolio’, select ‘Reports’, then ‘Capital Gain & Loss Statement’ to download. |

| Deadline | ITR filing deadline is July 31, 2025. |

| Customer Support | For queries, visit the Axis Direct website or contact customer support. |

Summary

The Axis Direct capital gains statement is crucial for every investor aiming for accurate tax reporting and efficient portfolio management. Accessing this statement is straightforward, as it can be downloaded easily through the Axis Direct web portal or mobile app. With the ITR filing deadline approaching on July 31, 2025, it’s imperative for investors to gather all necessary documentation, including capital gains statements, to ensure a smooth filing process. This statement aids in tracking gains and losses, ultimately facilitating better financial management and tax compliance.