FD interest rates have recently been a hot topic among investors, especially after several banks announced cuts following the RBI’s decision to reduce the benchmark repo rate. Understanding these rates is crucial for anyone looking to maximize their returns on fixed deposits. By comparing fixed deposit rates across various banks, savers can find the most lucrative options to grow their savings. For example, a small change in FD rates can significantly impact overall earnings, making it vital to stay updated on current FD rates. As we look ahead to FD rates in 2025, knowing where to find the best fixed deposit rates will help investors make informed decisions about their finances.

When it comes to saving money securely, bank fixed deposit schemes offer a reliable avenue for investors seeking growth with minimal risk. These deposits, commonly referred to as term deposits, provide an opportunity to earn fixed interest over a predetermined duration. Given the fluctuations in financial markets, understanding the nuances of interest rates offered can empower individuals to find the ideal savings plan. As financial institutions frequently update their offerings, prospective depositors must keep an eye on the competitive landscape of bank FD comparisons. With insights into the projected FD rates for the coming years, investors can strategically position their funds for greater yields.

Understanding FD Interest Rates

FD interest rates, or fixed deposit interest rates, are crucial for anyone looking to grow their savings securely. With recent adjustments made by banks, many of which have lowered their rates due to the RBI’s decrease in the repo rate, it’s vital for investors to stay informed about the current FD rates and how they impact potential earnings. Fixed deposits offer a guaranteed return, making them a preferred choice for risk-averse investors, but understanding the nuances of these rates can maximize the benefits of such investments.

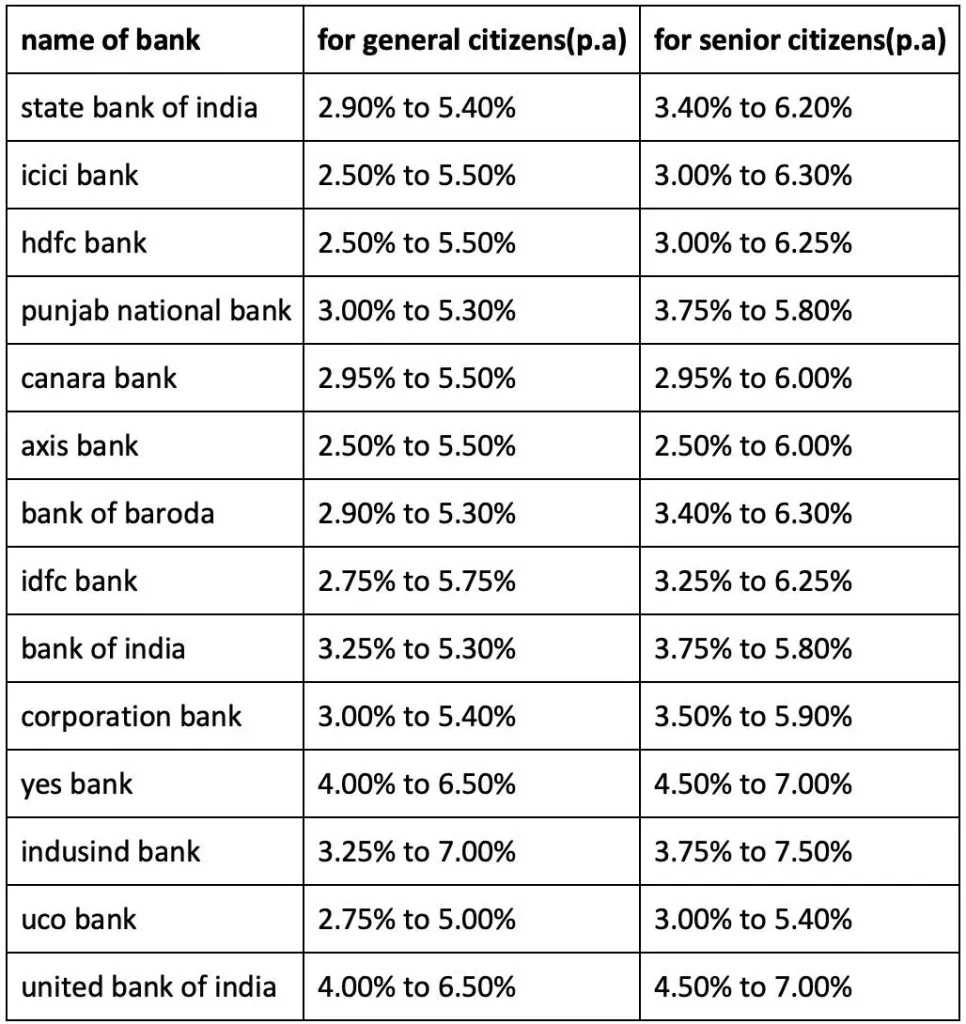

When considering FD interest rates, depositors should not only look at the nominal rate offered by one bank but should also engage in a bank FD comparison. This involves evaluating rates from various banks to locate the best fixed deposit rates available in 2025. For example, comparing HDFC, ICICI, and Kotak Mahindra Bank reveals significant differences, particularly for senior citizens who typically enjoy higher rates. Such comparisons ensure that you achieve the highest possible returns on your savings.

Best Fixed Deposit Rates in 2025

As we approach 2025, many banks are offering competitive fixed deposit interest rates, making it an opportune moment for savers to invest. Rates from HDFC Bank, for instance, offer attractive returns of up to 7.4% for senior citizens on longer tenures, which can significantly enhance one’s savings in the long term. Similarly, ICICI Bank boasts a top FD rate of 7.05% for two years, making it a strong contender in the current market.

Kotak Mahindra Bank and Federal Bank also present compelling options for investors, especially with their focus on senior citizen rates. With the FD rates fluctuating, potential investors should remain vigilant and consider not only the current FD rates but also the larger economic landscape, including how changes in monetary policy might influence interest rates over the next few months.

The Importance of Comparing Fixed Deposit Rates

Before committing your hard-earned money, comparing fixed deposit rates across banks is essential. While one bank may underline an attractive rate, another might have benefits that align better with your financial goals. For example, even with a slightly lower interest rate, a bank may offer better terms regarding early withdrawals or additional account features that enhance the overall banking experience.

Additionally, understanding how fixed deposit interest rates change in response to the RBI’s policy decisions can prepare you for future investments. By tracking current FD rates regularly, you can make timely decisions that optimize your earnings, particularly if the rates are subject to downward adjustments as seen this month.

Tax Implications on Fixed Deposits

An often-overlooked aspect of fixed deposits is the tax implications associated with interest income. Depending on your income tax bracket, the earnings from a fixed deposit can attract significant taxation, potentially diminishing the returns from what might appear to be lucrative fixed deposit interest rates. Investors should approach their FD investments with a tax strategy to mitigate possible losses.

For those in a higher tax bracket, it might be advisable to limit investments in fixed deposits or to consider tax-saving fixed deposit schemes that offer better benefits. Understanding these implications enables depositors to make informed decisions, balancing safety with tax efficiency.

Best Practices for FD Investments

Investing in fixed deposits might seem straightforward, but strategic planning can enhance the benefits. Consider diversifying your investments across various banks to spread risk and take advantage of higher fixed deposit rates available in the market. Engaging in a bank FD comparison not only helps in identifying the best rates but also optimizes your investment portfolio.

Moreover, timing also plays a crucial role in fixed deposit investments. Keeping an eye on upcoming monetary policy meetings, like those of the RBI, can give foresight into potential rate adjustments. By investing before anticipated rate hikes or locking in current rates before expected cuts can substantially benefit your overall returns.

Choosing the Right Tenure for Fixed Deposits

Selecting the right tenure for fixed deposits can significantly impact the returns earned. Short-term fixed deposits may offer flexibility but tend to have lower interest rates than long-term deposits. Thus, determining your financial goals is essential—if you can afford to lock away your funds for three or five years, opting for longer tenures can maximize returns amid varying FD interest rates.

Many investors are tempted to take advantage of the best fixed deposit rates by frequently changing their tenure as market rates fluctuate. However, it’s crucial to assess whether the anticipated rate changes justify this approach. In some cases, fixed deposit investments held to maturity may yield better results than chasing transient rate trends.

Understanding Bank FD Comparison

Conducting a thorough bank FD comparison allows investors to identify which banks are currently offering the best fixed deposit rates. Factors to consider during this process include the interest rate itself, tenure options, flexibility in terms of premature withdrawals, and any additional perks for loyal customers, such as loyalty bonuses or preferential rates for existing clients.

Moreover, consider the importance of bank stability when comparing FD options. While it’s tempting to chase the highest interest rates, the credibility of the bank and its deposit insurance status should also weigh into your decision-making process. This not only safeguards your funds but also complements a holistic approach to securing your financial future.

The Future of Fixed Deposit Rates

As we look forward to 2025, the future of fixed deposit interest rates appears to be influenced by several macroeconomic factors, including inflation rates and global financial conditions. Investors planning to navigate these shifting landscapes must remain vigilant about the potential of rising rates in response to economic recovery cycles.

Furthermore, tracking predictions from financial analysts regarding forthcoming RBI meetings can provide insights into how the policy direction could affect FD interest rates. Taking a proactive approach to these anticipated changes enables depositors to strategically decide when to invest or adjust existing portfolios for optimal performance.

Strategies for Maximizing Returns on Fixed Deposits

To maximize returns from fixed deposits, investors should consider using incremental investments instead of lump sums. By spreading deposits over time, one may take advantage of varying interest rates available and potentially lock in higher rates as they become available. This strategy can mitigate the impact of falling rates on your savings.

Additionally, opting for interest payout options that align with your financial needs can further enhance returns on fixed deposits. For example, choosing to receive quarterly interest instead of reinvesting can provide an immediate income stream, allowing for more flexible financial planning.

Frequently Asked Questions

What are the current FD interest rates for 2025 from major banks?

As of April 2025, the current FD interest rates vary among major banks. HDFC Bank offers rates up to 6.9% for a 3-year FD, ICICI Bank has the highest rate at 7.05% for a 2-year FD, and Kotak Mahindra Bank provides rates exceeding 7.1% on its one-year FD. It’s essential to compare these rates to maximize returns.

How do I compare fixed deposit rates among banks?

To effectively compare fixed deposit rates, consider using online FD calculators and interest comparison tools. Look for the nominal rates offered, maturity period, and whether the rates differ for senior citizens. This comparison will help you identify the best fixed deposit rates for your investment needs.

Will FD interest rates change in 2025?

FD interest rates can fluctuate based on economic conditions and RBI policy changes. Current predictions suggest that as the economy stabilizes, FD rates may see revisions. Monitoring updates from banks and the RBI can provide insight into expected FD rates for 2025.

What factors influence fixed deposit interest rates?

Fixed deposit interest rates are influenced primarily by the RBI’s repo rate, the lender’s operating costs, and the demand for loans. When the RBI decreases the repo rate, banks often cut their fixed deposit rates accordingly, as seen in recent adjustments.

Can senior citizens benefit from higher FD interest rates?

Yes, many banks offer higher FD interest rates specifically for senior citizens. For example, HDFC Bank’s fixed deposit rates are 7.4% for senior citizens on a 3-year FD, compared to 6.9% for the general public. It’s advisable for senior citizens to check these enhanced rates when investing.

Is the interest income from fixed deposits taxable?

Yes, the interest income from fixed deposits is subject to tax. Investors in higher tax brackets should be cautious and may want to limit their overall FD investments to manage tax liabilities effectively.

What is the benefit of investing in fixed deposits compared to other savings instruments?

Fixed deposits offer higher interest rates compared to regular savings accounts, making them a safer investment for guaranteed returns. They are ideal for risk-averse investors seeking stable income over a fixed term.

What should I consider before investing in fixed deposits?

Before investing in fixed deposits, consider the interest rates, tenure, tax implications, and your liquidity needs. Comparing current FD rates across banks ensures you find the best return for your savings.

How can I calculate the returns on my fixed deposit?

You can calculate returns on your fixed deposit using online FD calculators. Enter your principal amount, tenure, and interest rate to determine your maturity amount and total interest earned.

What happens if I withdraw my fixed deposit early?

Withdrawing a fixed deposit before its maturity period typically results in penalties and reduced interest rates. It’s crucial to understand the terms regarding premature withdrawal from your FD agreement.

| Bank Name | 1 Year | 2 Years | 3 Years |

|---|---|---|---|

| HDFC Bank | 6.6% (7.1% for senior citizens) | 6.7% (7.2% for senior citizens) | 6.9% (7.4% for senior citizens) |

| ICICI Bank | 6.7% (7.2% for senior citizens) | 7.05% (7.55% for senior citizens) | 6.9% (7.4% for senior citizens) |

| Kotak Mahindra Bank | 7.1% (7.6% for senior citizens) | 7.15% (7.65% for senior citizens) | 7% (7.5% for senior citizens) |

| Federal Bank | 6.85% (7.35% for senior citizens) | 7% (7.5% for senior citizens) | 7% (7.5% for senior citizens) |

Summary

FD interest rates have seen significant changes recently due to adjustments by various banks in response to the Reserve Bank of India’s monetary policy. With many banks reducing their rates, it is crucial for potential depositors to compare offerings. Higher FD interest rates can translate to substantial earnings over time, particularly for large deposits. Therefore, evaluating these rates and considering tax implications will be essential for maximizing returns.