The world is currently witnessing an unprecedented surge in inflation rates, with many countries reporting figures that have reached record highs. This phenomenon, often referred to as “global inflation,” is not just a passing trend; it signifies deeper economic challenges that are affecting consumers, businesses, and governments alike. As prices soar for essential goods and services, understanding the factors driving this inflation becomes crucial for anyone looking to navigate the current economic landscape.

In this article, we will delve into the various causes behind the rising inflation rates, including supply chain disruptions, increased demand post-pandemic, and monetary policies implemented by central banks. We will also explore the impact of these inflationary pressures on everyday life, from the cost of groceries to housing prices, and how they are reshaping consumer behavior. Furthermore, we will discuss potential strategies that individuals and businesses can adopt to mitigate the effects of inflation.

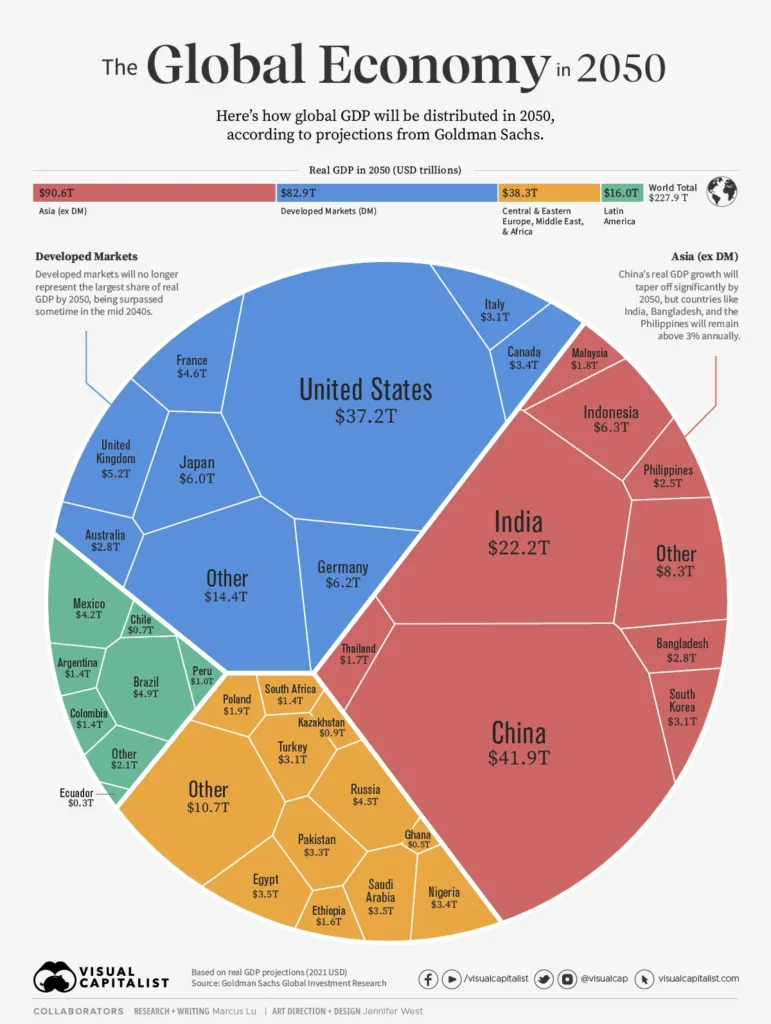

As we unpack the complexities of global inflation, you will gain insights into how different regions are responding to this crisis and what it means for the future of the global economy. Whether you are an investor, a business owner, or simply a curious reader, this article aims to equip you with the knowledge needed to understand and adapt to the changing economic environment. Stay with us as we navigate through the intricacies of record-high global inflation rates and their far-reaching implications.

In recent years, global inflation rates have surged to unprecedented levels, impacting economies worldwide. Understanding the factors contributing to this phenomenon is crucial for policymakers, businesses, and consumers alike. This article delves into various aspects of rising inflation rates, exploring their causes, effects, and potential solutions.

Causes of Rising Inflation

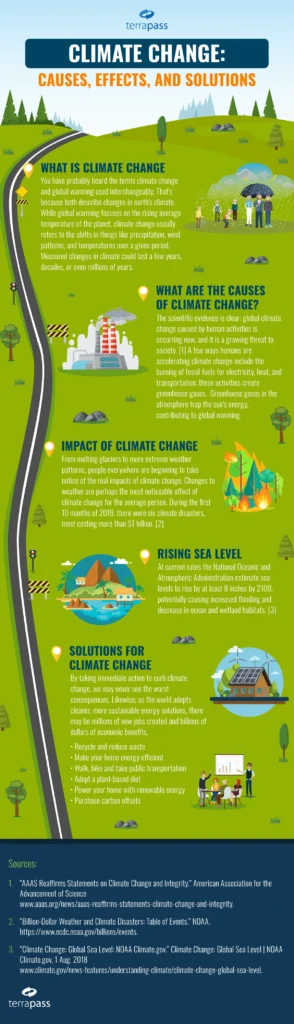

One of the primary drivers of rising inflation is the disruption of supply chains, exacerbated by the COVID-19 pandemic. As countries implemented lockdowns, production slowed, leading to shortages of goods. This imbalance between supply and demand has resulted in increased prices across various sectors, from consumer electronics to food products.

Additionally, government stimulus measures aimed at supporting economies during the pandemic have injected significant amounts of money into circulation. While these measures were necessary to prevent economic collapse, they have also contributed to inflationary pressures as more money chases the same amount of goods and services.

Impact on Consumer Behavior

As inflation rates rise, consumer behavior tends to shift. Many individuals become more cautious with their spending, prioritizing essential goods over luxury items. This change in consumer sentiment can lead to decreased demand for non-essential products, impacting businesses and potentially leading to layoffs or reduced hours for employees.

Moreover, consumers may begin to stockpile goods in anticipation of further price increases, creating a self-fulfilling prophecy that exacerbates inflation. This behavior can lead to shortages and further price hikes, creating a cycle that is difficult to break.

Inflation and Interest Rates

Central banks often respond to rising inflation by increasing interest rates to curb spending and borrowing. Higher interest rates can slow down economic growth, as loans for homes, cars, and businesses become more expensive. This balancing act is crucial for maintaining economic stability, but it can also lead to unintended consequences, such as reduced investment and slower job growth.

Investors closely monitor central bank policies, as changes in interest rates can significantly impact financial markets. A sudden increase in rates may lead to volatility in stock prices, affecting retirement accounts and investment portfolios for millions of individuals.

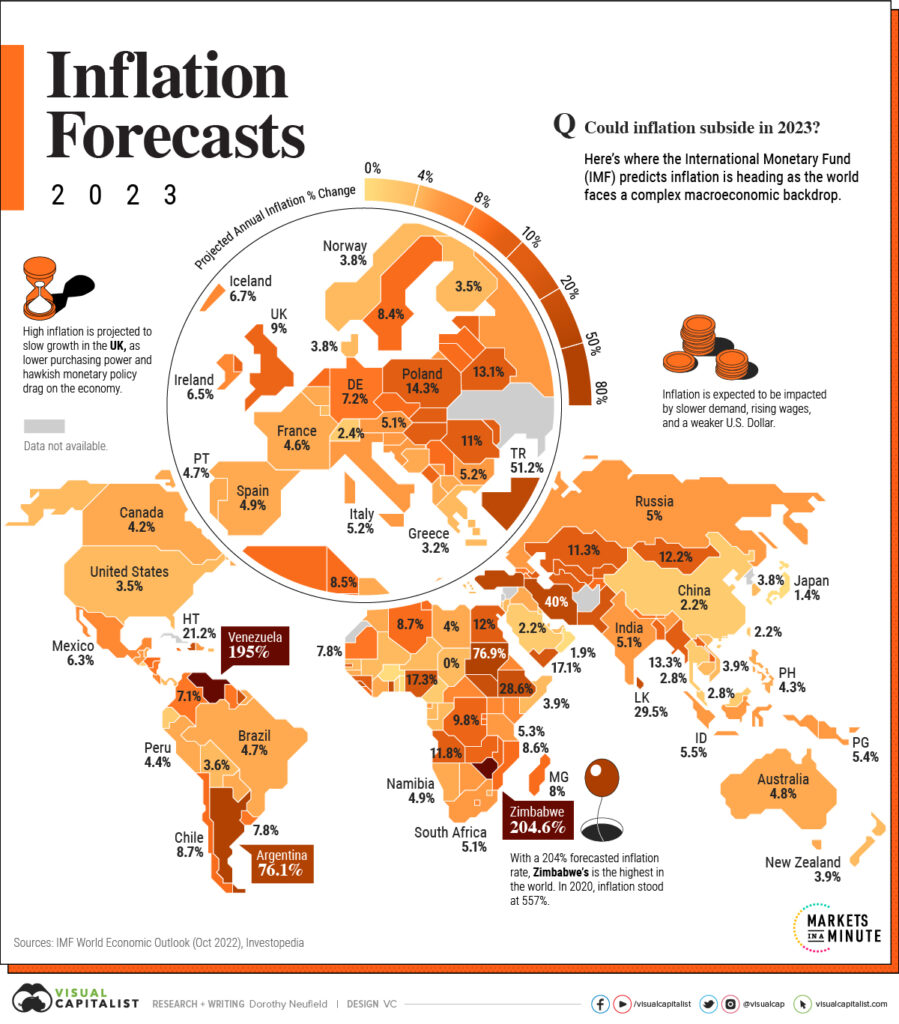

Global Disparities in Inflation Rates

Inflation rates are not uniform across the globe; different countries experience varying levels of inflation based on their economic conditions. For instance, developing nations may face higher inflation due to currency devaluation and reliance on imported goods, while developed countries may see more moderate increases due to stronger economic fundamentals.

This disparity can lead to challenges in international trade, as countries with high inflation may struggle to compete with those that maintain stable prices. Understanding these differences is essential for businesses operating in multiple markets, as they must adapt their strategies to navigate diverse economic landscapes.

Long-term Consequences of High Inflation

Persistently high inflation can have long-term consequences for economies. It erodes purchasing power, making it more difficult for consumers to afford basic necessities. This can lead to increased poverty rates and social unrest, as individuals struggle to make ends meet.

Furthermore, businesses may face challenges in planning for the future, as unpredictable costs can hinder investment decisions. This uncertainty can stifle innovation and growth, ultimately impacting the overall health of the economy.

Strategies for Mitigating Inflation

Governments and central banks have several tools at their disposal to combat rising inflation. These include adjusting interest rates, implementing fiscal policies, and regulating supply chains to ensure a steady flow of goods. Additionally, promoting competition within markets can help keep prices in check.

Consumers can also take proactive steps to mitigate the effects of inflation on their finances. Budgeting, prioritizing essential purchases, and seeking out discounts can help individuals navigate challenging economic times. By understanding the factors driving inflation and taking informed actions, both consumers and policymakers can work towards stabilizing the economy.

Inflation has become a pressing issue worldwide, affecting economies, consumers, and businesses alike. This summary provides an overview of the current state of global inflation rates, their causes, and implications.

| Region | Current Inflation Rate (%) | Key Factors | Implications |

|---|---|---|---|

| North America | 8.5 | Supply chain disruptions, increased consumer demand, energy prices | Higher cost of living, potential interest rate hikes |

| Europe | 7.0 | Energy crisis, post-pandemic recovery, geopolitical tensions | Economic slowdown, increased inflation expectations |

| Asia | 5.5 | Commodity price increases, supply chain issues | Impact on exports, potential for currency fluctuations |

| Latin America | 9.0 | Political instability, high food prices, currency depreciation | Social unrest, challenges in economic policy |

| Africa | 6.5 | Food insecurity, energy costs, global market trends | Increased poverty rates, pressure on governments |

Conclusion

The record-high inflation rates across various regions highlight the interconnectedness of global economies and the challenges they face. Policymakers must navigate these turbulent waters to stabilize their economies and protect consumers.