Insurance for Electric Vehicles is becoming an essential aspect of owning an electric vehicle (EV), especially as the demand for eco-friendly transportation rises. With unique features and potential risks, securing appropriate coverage for your EV requires thorough understanding and planning. EV insurance often includes aspects such as battery coverage for EVs, which can protect your investment significantly, given the high costs associated with battery replacement. Additionally, comprehensive coverage for EVs is recommended to safeguard against unforeseen events that might affect your vehicle. In this guide to electric vehicle insurance, you will discover important tips and strategies to achieve premium savings and ensure the best coverage options available.

As the landscape of personal transportation continues to evolve, purchasing electric vehicle (EV) insurance is now more crucial than ever for car owners transitioning from traditional fuel vehicles. This insurance not only mitigates risks associated with EV ownership but also highlights the need for specialized coverage such as battery protection plans and comprehensive policies tailored specifically for these modern vehicles. With the rising popularity of sustainable mobility, understanding the nuances of electric vehicle insurance is vital for maximizing benefits, including potential premium savings. Whether you’re considering battery coverage or need guidance on navigating your options, this inclusive electric vehicle insurance guide will equip you with the knowledge you need to protect your new investment.

Understanding EV Insurance Costs

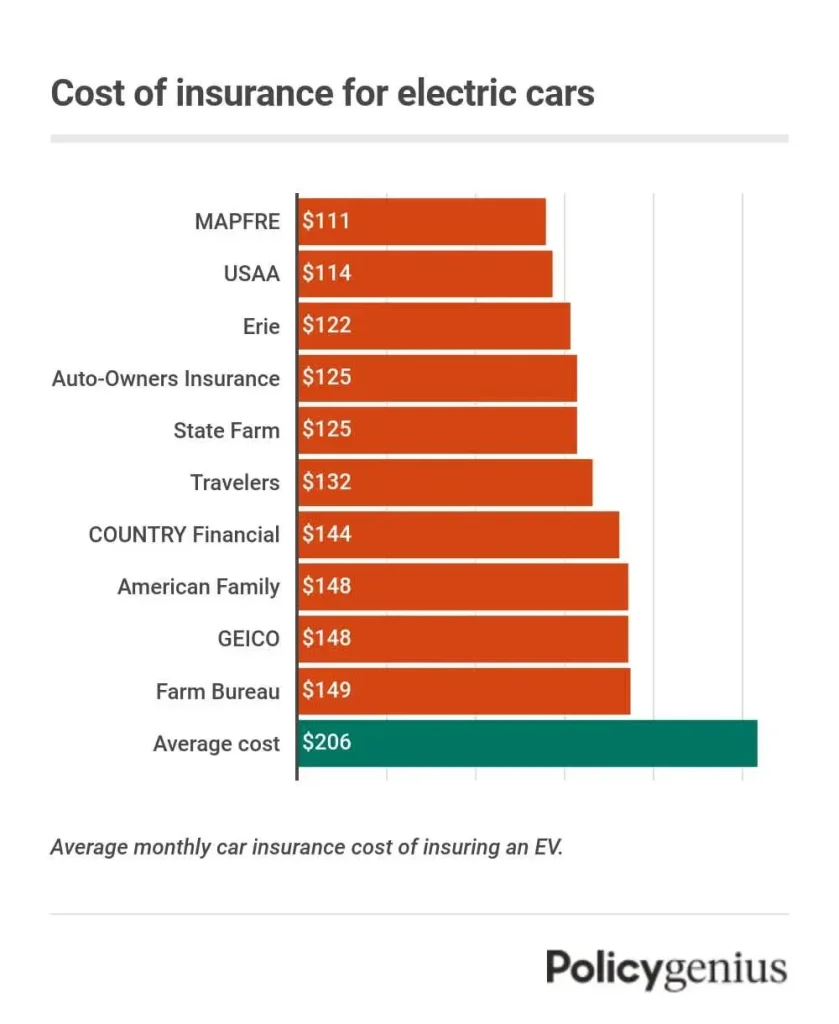

The cost of insurance for electric vehicles (EVs) tends to be significantly higher compared to traditional petrol or diesel vehicles, and there are a couple of critical reasons behind this phenomenon. First, the Insured Declared Value (IDV) for EVs is generally higher due to the intrinsic value of the vehicle itself. The calculation of insurance premiums takes into account the vehicle’s price, model, and manufacturer, and since EVs are often priced above their conventional counterparts, this directly impacts insurance costs.

Moreover, EVs often incur additional complexities, such as specialized parts and technologies that can result in higher repair costs. This heightened value and potential for increased repair expenses lead insurance providers to adjust their premium rates accordingly. Given these aspects, it’s essential for potential EV owners to understand these cost factors when considering insurance options.

Importance of Battery Coverage in EV Insurance

Battery coverage is a crucial aspect of electric vehicle insurance that many owners overlook. Unlike standard auto insurance, which covers the vehicle’s structure and mechanics, battery coverage protects one of the most expensive and essential components of an EV: the battery itself. Since most insurance policies do not include battery coverage by default, EV owners should proactively seek out this add-on to safeguard against significant out-of-pocket expenses related to battery replacement.

Purchasing battery coverage can be a game changer, especially as the lifespan of EV batteries can vary significantly depending on usage and environmental conditions. The initial investment in additional battery coverage can save owners a substantial amount in the long run, given that replacing an EV battery can cost anywhere from 40% to 50% of the vehicle’s total cost. Therefore, integrating battery coverage into your EV insurance plan is not just beneficial but can also be seen as an essential investment in vehicle longevity.

Essential Add-Ons for Electric Vehicle Insurance

When selecting insurance for electric vehicles, beyond the standard coverage, exploring essential add-ons can significantly enhance your protection. One such important add-on is zero-depreciation coverage, which ensures that wear and tear on your EV does not impact the final claim amount in case of damage. This is particularly vital for newer EV models, where depreciation could lead to substantial loss if not adequately covered.

Additionally, considering a motor protector cover is advisable for EV owners. This coverage provides extra protection for the complex electric motor components that are specific to EVs. Furthermore, including coverage for charging stations, sensors, and cameras can prevent unexpected costs from damages or losses incurred to these specialized parts. By considering these add-ons, EV owners can significantly enhance their insurance coverage and contribute to overall peace of mind.

Evaluating Third-Party Insurance Options for EVs

As with traditional vehicles, third-party insurance is a mandatory requirement for electric vehicles. Third-party EV insurance provides financial protection against damages to another party involved in an accident caused by the insured EV. This includes compensation for injuries, property damage, and even legal liabilities, thus safeguarding the owner against significant financial burdens in the event of an incident.

The distinction in how EV insurance premiums are calculated also plays a vital role. For EVs, premiums are often assessed based on kilowatts (Kw) rather than cubic capacity, which is the norm for petrol and diesel vehicles. Consequently, understanding these nuances in coverage can help EV owners make informed decisions, ensuring they opt for policies that suit their specific needs without incurring unnecessary costs.

Premium Savings with Electric Vehicle Insurance

While the initial costs for electric vehicle insurance may seem steep, there are several avenues through which drivers can achieve premium savings. For instance, many insurance providers offer special discounts or incentives for insuring EVs due to their eco-friendly nature and less severe accident risks compared to gasoline vehicles. Contributors to these savings include utilizing telematics devices that monitor driving habits, which can demonstrate responsible driving and result in further discounts on premiums.

Moreover, some insurers provide bundled policies that cover multiple vehicles or comprehensive home and auto plans, which can yield considerable savings. Ensuring your EV is covered by such plans can lead to reduced overall premiums and increased protection without a significant financial outlay, making it a win-win scenario for savvy EV owners.

Navigating the EV Insurance Landscape in India

In India, as the adoption of electric vehicles rises, understanding the evolving landscape of EV insurance is crucial for consumers. The market is becoming increasingly competitive, with several insurers offering specialized policies tailored to the unique requirements of EVs. As a result, it is imperative for potential buyers to conduct thorough research, comparing different insurance plans to find the most suitable coverage that aligns with their lifestyle and budget.

Additionally, staying informed about any changes in insurance regulations or incentives introduced by the government can provide further opportunities for savings or improvements in coverage options. Navigating these factors not only enhances the protection provided through EV insurance but also helps in maximizing potential savings while ensuring peace of mind.

Benefits of Comprehensive Coverage for Electric Vehicles

Choosing comprehensive coverage for electric vehicles offers an array of benefits that go beyond standard insurance policies. Comprehensive coverage protects against a wide range of risks, including theft, vandalism, natural disasters, and fire, thereby providing broader protection than basic plans. This is especially important for expensive EVs, where the financial implications of potential damages can be significant.

Moreover, comprehensive coverage allows for greater peace of mind, as EV owners can feel secure knowing that they have protection from unforeseen incidents. This level of coverage can include essential repairs that may arise from accidents and extends to cover a range of components, including potentially high-cost accessories that are unique to electric vehicles.

Understanding Co-payment and Deductible Clauses in EV Insurance

It is crucial for electric vehicle owners to pay attention to co-payment and deductible clauses when selecting insurance coverage. A co-payment is a cost-sharing arrangement where the insured agrees to pay a fixed percentage of the claim amount. This means that in the event of damage or loss, EV owners need to be prepared for some out-of-pocket expenses, which can catch many by surprise if they have not thoroughly read their policy details.

Deductibles function similarly, demanding that owners pay a specific amount upfront before the insurer covers the rest of the claim. Different policies have varying deductible amounts, and understanding these terms allows EV owners to select plans that best suit their financial situation. Policies with lower deductibles may lead to higher premiums, while those with higher deductibles may result in lower premiums, thus making informed choices essential.

The Future of Electric Vehicle Insurance and Market Trends

As electric vehicles gain popularity, the future of EV insurance is evolving in intriguing ways. Currently, there is a noticeable trend towards manufacturers providing integrated insurance options directly with vehicle purchases, simplifying the process for consumers. Additionally, advancements in technology, such as telematics, are becoming common, allowing insurers to offer personalized premiums based on actual driving behavior rather than traditional metrics.

Furthermore, as more data becomes available regarding EV performance and claims, insurers may develop more tailored products that better meet the needs of electric vehicle owners. This could include specialized coverage options that focus on battery longevity, repair costs, and even incentives for environmentally friendly driving. The future of insurance for electric vehicles looks promising, with opportunities for innovation that can benefit both consumers and companies in this competitive market.

Frequently Asked Questions

Why is insurance for electric vehicles (EVs) generally more expensive than for traditional cars?

Insurance for electric vehicles tends to be more expensive due to a higher Insured Declared Value (IDV), as EVs usually have a higher market price compared to petrol and diesel vehicles. Additionally, factors like the model, manufacturer, battery capacity, and the vehicle’s geographic registration area significantly influence the insurance premiums for EVs.

Does my comprehensive coverage EV policy include battery coverage for my electric vehicle?

Most standard comprehensive coverage EV policies do not include battery coverage by default. However, many insurance providers offer battery coverage as an add-on option. It’s crucial for EV owners to consider this additional coverage to protect against potential battery replacement costs.

What should I consider before opting for battery coverage in my electric vehicle insurance?

When considering battery coverage for your electric vehicle insurance, assess factors such as the vehicle’s age, the sum insured for the battery, your geographical location’s risks, and terms related to co-payments and deductibles. Choosing higher coverage options can save you from significant out-of-pocket expenses in the future.

What are some essential add-ons in my insurance for electric vehicles?

Important add-ons to consider for your electric vehicle insurance include motor protector coverage to mitigate repair costs for your EV motor, zero-depreciation coverage to ensure you receive full claim amounts without depreciation deductions, and coverage for essential equipment like charging stations and sensors.

Is third-party motor insurance coverage necessary for electric vehicles?

Yes, third-party motor insurance is mandatory for electric vehicles, similar to petrol and diesel cars. This insurance protects you against liabilities such as damage to third-party property, bodily injury, natural disasters, and theft. It’s advisable to select a comprehensive policy to ensure adequate financial protection.

How can I achieve premium savings with EV insurance?

To achieve premium savings with EV insurance, consider options such as opting for higher deductibles, maintaining a clean driving record, and bundling policies with the same insurer. Additionally, exploring various insurance providers and comparing their coverage terms can help you find the best premium rates for comprehensive coverage EVs.

Are there any special considerations for insuring electric vehicles in flood-prone areas?

When insuring electric vehicles in flood-prone areas, consider choosing a higher sum insured for battery coverage to account for increased risks like water damage. It is important to ensure adequate coverage in these regions, even if it leads to slightly higher premiums, to protect your EV from potential losses.

| Key Points | Details |

|---|---|

| Insurance Costs | Insurance rates for electric vehicles (EVs) are generally higher due to a higher Insured Declared Value (IDV) compared to petrol and diesel vehicles. |

| Battery Coverage | Typically, standard insurance policies for EVs do not cover batteries. Battery protection is often available as an add-on. |

| Factors for Battery Coverage | When considering battery coverage, factors like the vehicle’s age, sum insured, geographical location, and co-payments should be evaluated. |

| Essential Add-ons | Add-ons to consider include motor protector coverage, zero-depreciation coverage, and road assistance coverage to enhance protection. |

| Policy Types | Third-party insurance and other standard features applicable to petrol/diesel vehicles also apply to EV insurance. |

Summary

Insurance for Electric Vehicles is increasingly essential due to their rising popularity. As electric vehicles become more common, understanding the specific insurance requirements becomes crucial. Prospective buyers should be aware of the higher costs associated with insurance, particularly regarding battery coverage and essential add-ons. Evaluating these factors can help EV owners secure the comprehensive protection they need while optimizing their insurance costs.