The recent surge in oil prices amid Middle East tensions has sent shockwaves through global markets, raising concerns about economic stability and energy security. As geopolitical conflicts escalate, the oil supply chain faces unprecedented challenges, leading to fluctuations that impact consumers and industries alike. Understanding the dynamics behind this surge is crucial for anyone looking to navigate the complexities of today’s energy landscape.

In this article, we will delve into the factors driving the increase in oil prices, including the role of OPEC, regional conflicts, and the impact of sanctions on oil-producing nations. We will also explore how these rising prices affect not only the cost of fuel but also the broader implications for inflation and economic growth worldwide. By examining these elements, readers will gain a comprehensive understanding of the current situation and its potential long-term effects.

Furthermore, we will discuss strategies that consumers and businesses can adopt to mitigate the impact of rising oil prices on their budgets. From alternative energy sources to changes in consumption patterns, there are various ways to adapt to this evolving scenario. Stay with us as we unpack these critical insights and equip you with the knowledge needed to make informed decisions in a rapidly changing environment.

Historical Context of Oil Prices and Geopolitical Tensions

The relationship between oil prices and geopolitical tensions in the Middle East has a long and complex history. Events such as the 1973 oil crisis and the Gulf War have shown how conflicts can lead to significant fluctuations in oil prices. When tensions rise, especially in oil-rich regions, markets react swiftly, often leading to price surges. Understanding this historical context is crucial for analyzing current trends in oil pricing.

In recent years, incidents such as the U.S.-Iran tensions and conflicts in Syria have reignited concerns over oil supply disruptions. These geopolitical factors create uncertainty in the market, prompting investors to speculate on future prices. As a result, oil prices often reflect not just current supply and demand, but also the potential for future conflicts that could impact production and distribution.

Impact of OPEC Decisions on Oil Prices

The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in regulating oil prices through its production quotas. When tensions rise in the Middle East, OPEC’s decisions can have an amplified effect on global oil prices. For instance, if OPEC decides to cut production in response to geopolitical instability, prices are likely to rise due to reduced supply.

Moreover, OPEC’s ability to influence prices is often tested during times of crisis. The group’s unity can be challenged, leading to differing opinions among member countries on how to respond to rising tensions. This internal conflict can further complicate the market’s reaction, as investors weigh the potential for increased production against the backdrop of geopolitical risks.

The Role of Speculation in Oil Price Fluctuations

Speculation is a key driver of oil price fluctuations, particularly during periods of heightened geopolitical tension. Traders often react to news and events in the Middle East, buying or selling oil futures based on their predictions of future supply disruptions. This speculative trading can lead to rapid price increases, even before any actual supply issues occur.

Additionally, the rise of algorithmic trading has intensified the impact of speculation on oil prices. Automated systems can react to news in milliseconds, amplifying price movements. As a result, the oil market can experience volatility that is disproportionate to the actual changes in supply and demand, driven largely by speculative behavior.

Economic Consequences of Rising Oil Prices

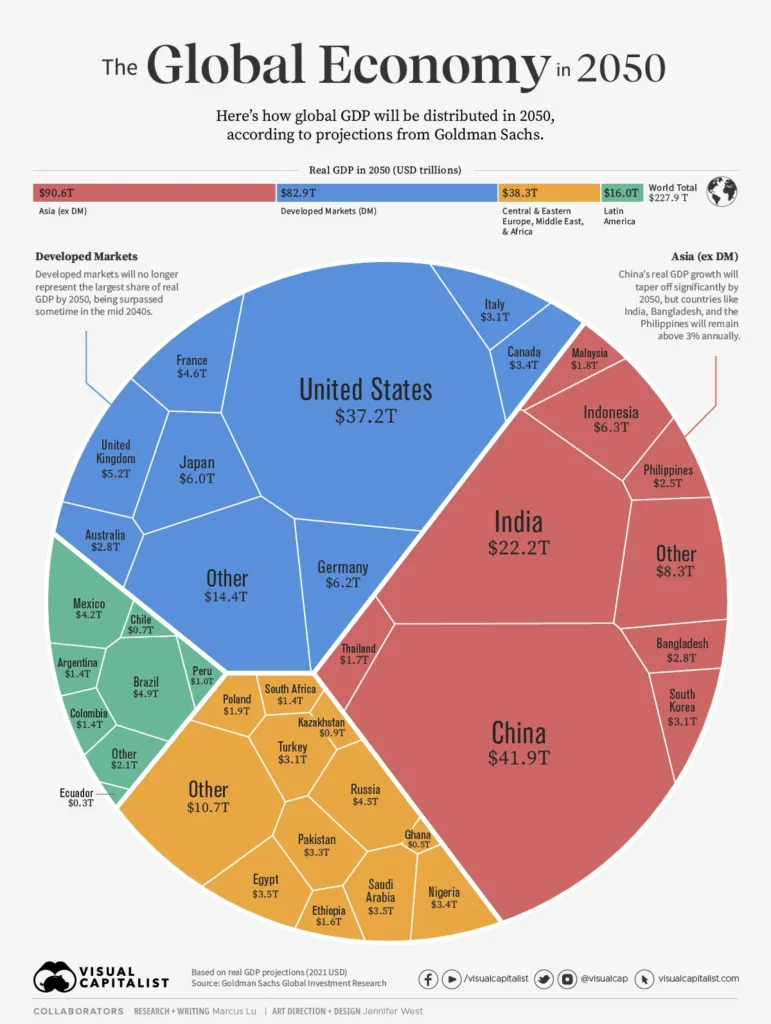

Surging oil prices can have far-reaching economic consequences, affecting everything from consumer prices to global economic growth. Higher oil prices typically lead to increased costs for transportation and manufacturing, which can result in inflationary pressures. This, in turn, can impact consumer spending and overall economic activity.

Moreover, countries that are heavily reliant on oil imports may face significant challenges as prices rise. For these nations, increased oil costs can lead to trade imbalances and currency depreciation. Conversely, oil-exporting countries may experience economic booms, but they also face the risk of over-reliance on oil revenues, which can be volatile.

Renewable Energy and Its Impact on Oil Prices

The rise of renewable energy sources is beginning to influence oil prices, particularly as countries seek to reduce their dependence on fossil fuels. As more investments are made in solar, wind, and other renewable technologies, the demand for oil may decrease over time. This shift could lead to a long-term decline in oil prices, even in the face of geopolitical tensions.

However, the transition to renewable energy is not instantaneous. In the short term, geopolitical tensions can still lead to price surges as the world remains reliant on oil. The interplay between renewable energy development and traditional oil markets will be a critical factor in shaping future oil price dynamics.

Future Outlook: Oil Prices and Middle East Stability

The future of oil prices is closely tied to the stability of the Middle East. As tensions continue to simmer, the potential for supply disruptions remains a significant concern for global markets. Analysts predict that unless there is a resolution to ongoing conflicts, oil prices may continue to experience volatility.

Furthermore, the geopolitical landscape is constantly evolving, with new players and alliances emerging. The impact of these changes on oil prices will depend on how they affect production capabilities and market perceptions. Investors and policymakers alike must remain vigilant in monitoring these developments to navigate the complexities of the oil market.

| Aspect | Details |

|---|---|

| Current Situation | Recent escalations in the Middle East have led to increased geopolitical tensions, impacting global oil supply. |

| Price Increase | Oil prices have surged by over 5% in response to fears of supply disruptions due to conflicts in the region. |

| Market Reaction | Investors are reacting to the uncertainty, leading to volatility in oil markets and affecting stock prices of energy companies. |

| Historical Context | Similar price surges have occurred in the past during periods of conflict in the Middle East, highlighting the region’s influence on global oil markets. |

| Future Outlook | Analysts predict that if tensions continue, oil prices may remain high, potentially leading to increased inflation and economic impacts worldwide. |

| Government Response | Governments are monitoring the situation closely, with some considering strategic reserves to stabilize markets if necessary. |