Starting your credit journey can feel overwhelming, especially for those who are new to credit and unsure where to begin. Understanding key credit building tips is essential to establishing a robust credit profile. By responsibly using credit card options and making timely payments, you can effectively start building your credit history from day one. As a first-time credit user, it’s crucial to recognize that small, consistent behaviors can lead to significant improvements in your credit score. Embracing this journey not only opens doors to future financial opportunities but also helps you navigate the evolving landscape of credit with confidence.

Embarking on your financial path means taking important steps to establish your borrowing identity. Whether you’re a newcomer to the world of credit or looking to enhance your financial savvy, understanding how to build credit effectively is vital. The credit landscape has shifted, making it easier than ever for individuals to secure loans and credit cards. With an awareness of responsible financial practices, you can lay a solid foundation for your credit history. This process involves careful credit card management and timely repayments, which bolster your creditworthiness in the long run.

Starting Your Credit Journey: Key Steps for Success

Embarking on your credit journey can be overwhelming, but understanding the key steps can simplify the process. The first step is to familiarize yourself with the credit fundamentals, particularly the significance of building your credit history early. For first-time credit builders, the importance of responsible credit card usage cannot be overstated. Regularly using a credit card for small, manageable purchases and paying off the balance in full and on time is an effective strategy. This habit lays the groundwork for a robust credit score, opening doors to favorable loan terms and interest rates in the future.

As you start your credit journey, don’t overlook the essential concept of credit utilization. By ensuring that you utilize less than 30% of your credit limit, you demonstrate responsible borrowing to lenders. This practice not only helps you maintain a healthy credit score but also instills good financial habits that are vital as you navigate your path to financial independence. Being proactive about your credit can prevent financial pitfalls and confusion down the line, allowing you to build a solid credit foundation.

Essential Credit Building Tips for First-Time Users

Navigating the world of credit can be daunting for beginners, especially with various options available. For those new to credit, understanding credit card usage is pivotal. One of the essential credit building tips for first-time users is to familiarize yourself with how credit scores are generated. Your credit score is influenced by factors such as payment history, credit utilization, and the length of your credit history. By prioritizing timely payments and keeping your credit utilization low, you set the stage for a positive credit history.

Moreover, aspiring credit builders should utilize tools such as automatic payments to establish consistency in their payment habits. These tools help prevent late payments, which can severely impact your credit score. Additionally, regularly checking your credit report for inaccuracies ensures that your credit profile accurately reflects your borrowing behavior. Building your credit requires attentive management and a proactive approach to avoid potential pitfalls like missed payments or high credit utilization.

Avoiding Common Pitfalls in Credit Management

As you embark on your credit journey, it’s crucial to be aware of common pitfalls that can hinder your progress. One such common trap is the temptation to apply for multiple credit products in a short span. This ‘credit shopping’ behavior can negatively impact your credit score due to hard inquiries recorded on your report. Instead of applying indiscriminately, take the time to research and consider what type of credit you truly need. This measured approach not only protects your score but also fosters disciplined borrowing habits.

Another common mistake for new credit users is exceeding their credit limit. Utilizing too much of your available credit can signal financial instability to lenders. To avoid this, implement a judicious spending strategy by keeping your purchases within a manageable range of your credit limit. Couple this with an unwavering commitment to pay your dues in full every month. By setting these personal financial boundaries, you’ll pave the way for a healthy credit profile that stands the test of time.

Cultivating Discipline: The Key to Credit Success

Discipline is the cornerstone of a successful credit journey. From the outset, new credit users need to develop habits that reinforce financial responsibility. One of the most critical practices is to always pay your credit card dues on time. Late payments severely impact your credit score and can lead to lingering consequences that affect your future borrowing potential. By automating payments or setting reminders, you can cultivate this essential discipline.

Furthermore, establishing a budget that allows for timely debt payments is vital. Knowing how much you can afford to pay each month not only aids in maintaining a good credit score but also contributes to long-term financial well-being. Good credit behavior enables you to access better credit facilities in the future, whether for a mortgage, car loan, or personal credit. Thus, making prudent financial choices from day one ensures a rewarding credit journey.

Understanding Your Credit Score: A Necessity for First-Timers

A solid understanding of your credit score is essential for anyone starting their credit journey. Credit scores are calculated based on several key factors, including payment history, credit utilization, and the length of credit history. For those new to credit, focusing on building a good payment history is crucial as it accounts for a significant portion of your score. Timely payment of your monthly dues demonstrates reliability and commitment to lenders.

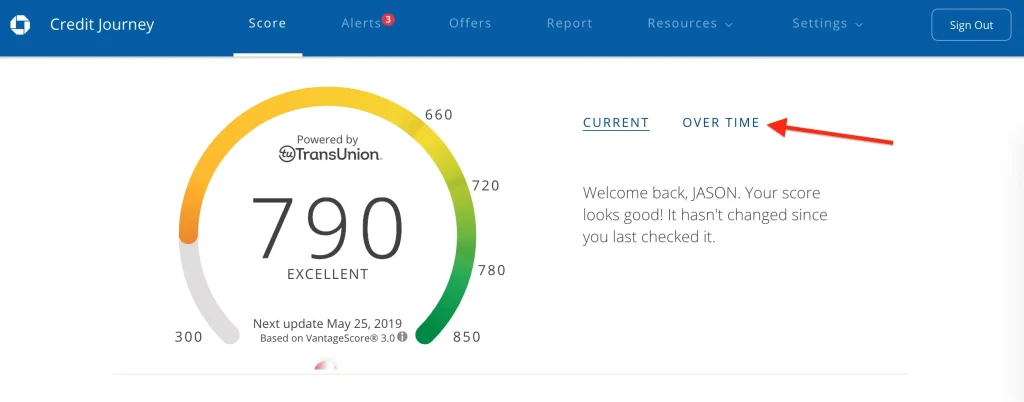

In addition to timely payments, understanding the importance of credit utilization cannot be overstated. Keeping your utilization below 30% of your total credit limit is not just a recommendation but a best practice for maintaining a favorable credit score. Monitoring your credit score regularly through various services allows you to track your progress and make informed financial decisions. This continual awareness of your credit standing empowers you to navigate your credit journey confidently.

Monitoring Your Credit Health Regularly

For first-time credit users, maintaining an ongoing awareness of your credit health is paramount. Regularly checking your credit report helps ensure that the information being reported is accurate and free from errors. This practice allows you to catch any discrepancies early on, which can safeguard your credit standing. Utilizing the free annual credit reports available in many countries can provide you with insights into your financial behavior without affecting your credit score.

Additionally, many credit monitoring services offer alerts that notify you of significant changes to your credit report. These alerts can be vital in preventing identity theft or quickly addressing issues before they escalate. By adopting a proactive approach to monitoring your credit, you not only help maintain a healthy credit score but also feel empowered in managing your finances effectively.

Building a Positive Credit History Through Responsible Borrowing

Building a positive credit history is essential for future financial endeavors, and responsible borrowing is key to achieving this goal. First-time credit users should embrace the notion that credit is a tool that, when handled wisely, can open various financial opportunities. Utilizing credit cards for small purchases and ensuring that they are paid off in full each month not only aids in building credit history but also instills long-lasting positive financial habits.

Moreover, being mindful of your borrowing limits and avoiding aggressive spending can protect you from falling into debt troubles. Managing your credit effectively from the start lays the groundwork for a robust credit history that lenders will consider favorable when assessing your future borrowing eligibility. Emphasizing responsible borrowing not only boosts your credit score but also enhances your overall financial literacy.

Moving Forward: Leveraging Good Credit for Future Opportunities

Once you’ve established a positive credit history, it’s important to understand how to leverage that credit for future opportunities. Good credit can help you secure better interest rates on loans, including mortgages, car loans, and personal loans. As you move forward in your credit journey, consider utilizing this advantage to minimize borrowing costs and optimize your financial commitments.

Additionally, having a strong credit score can provide leverage for negotiations with lenders. Many financial institutions are willing to offer better terms, such as lower fees and higher credit limits, to borrowers with solid credit histories. As you continue to build and maintain your credit health, you will find more financial doors opening, allowing you to achieve your personal and financial goals with ease.

The Role of Financial Education in Credit Building

Financial education plays a crucial role in the success of your credit journey. Understanding the nuances of credit, interest rates, and how different types of credit impact your financial health is essential for beginners. Educational resources are abundant, from online courses to community workshops, and engaging with these can empower you to make informed decisions about your credit and finances.

Moreover, seeking guidance from financial professionals can provide personalized insights into the complexities of credit management. Establishing a strong foundation of financial literacy enables first-time credit users to navigate their credit journey with confidence and helps to instill lifelong good financial habits that will serve them well in the future.

Frequently Asked Questions

What are the best credit building tips for those starting their credit journey?

When starting your credit journey, use a credit card wisely by keeping your spending under 30% of your limit, paying your balance in full and on time, and only using it for essential expenses. This responsible financial behavior helps build a positive credit history.

How can first-time credit holders build their credit history?

First-time credit holders can build their credit history by using a credit card responsibly. Make timely payments, avoid maxing out your credit limit, and monitor your credit through credit bureaus to understand your progress and maintain a healthy credit score.

What should new credit users avoid while starting their credit journey?

New credit users should avoid taking out multiple small loans or credit inquiries, as this can negatively impact creditworthiness. Instead, focus on managing one credit card and monitoring your credit health through direct-to-consumer credit reports.

Why is it important to start your credit journey early?

Starting your credit journey early allows you to establish a credit history before you need financial assistance. This proactive approach can help you secure better credit terms and limits as you build your financial credibility over time.

What is the golden rule for building credit during your credit journey?

The golden rule for building credit during your credit journey is to always pay your dues on time in full. This habit is crucial for maintaining a strong credit score and provides access to better credit facilities in the future.

How does responsible credit card usage affect new to credit individuals?

Responsible credit card usage helps new to credit individuals create a positive credit footprint. By paying bills on time and keeping balances low, they demonstrate financial responsibility, which lenders favor when assessing creditworthiness.

How can one determine their credit eligibility without impacting their score?

To determine credit eligibility without impacting your score, request a Direct-to-Consumer (D2C) credit report. This allows you to check your credit health without triggering an inquiry, helping you maintain a healthy credit profile.

What are the consequences of maxing out your credit limit early in your credit journey?

Maxing out your credit limit can negatively impact your credit score by indicating financial distress to lenders. It’s essential to manage your credit utilization by keeping balances low to demonstrate responsible financial behavior.

| Key Point | Description |

|---|---|

| Evolving Perception of Credit | Credit is now more accessible to young individuals compared to past generations. |

| Using Credit Responsibly | Using a credit card responsibly is crucial for building a positive credit history. |

| Essential Payment Habits | Paying on time and keeping spending below 30% of your credit limit will positively impact your credit score. |

| Building Credit Early | Start building your credit history early by using a credit card and demonstrating responsible financial behavior. |

| Avoiding Pitfalls | Avoid taking multiple loans or short-term small-ticket loans, as this can signal financial instability. |

| Monitoring Credit Health | Use Direct-to-Consumer (D2C) credit reports to track your credit health without negatively impacting your score. |

| The Golden Rule | Always pay dues on time and in full to maintain a strong credit score. |

Summary

To start your credit journey, it’s vital to recognize the evolved perception of credit as a tool for financial growth rather than a source of debt. Responsible credit card usage, timely payments, and disciplined financial behavior are the keys to building a positive credit history. By starting early and avoiding common pitfalls, you can set the stage for a successful financial future, ensuring access to credit opportunities when you need them.