Fintech, or financial technology, refers to the use of technology to deliver financial services in a more efficient and innovative way. This includes everything from mobile banking and peer-to-peer lending to cryptocurrency and robo-advisors. Fintech is developing rapidly, with new startups and established financial institutions alike embracing the latest technological advancements to improve the customer experience and streamline financial processes. The growth of Fintech has also led to increased competition and disruption in the traditional financial industry, as well as new opportunities for financial inclusion and accessibility.

The evolution of Fintech has sparked curiosity about its impact on traditional banking, the security of digital financial transactions, the future of cashless societies, the role of artificial intelligence in financial decision-making, and the potential for blockchain to revolutionize the way we store and transfer value. As Fintech continues to gain momentum, questions arise about regulatory challenges, the potential for job displacement, the democratization of investment opportunities, and the ethical implications of data privacy in the digital financial world. These developments and debates are shaping the future of finance and are worth exploring in more detail.

1. Definition of Fintech

Fintech, short for financial technology, refers to the innovative use of technology in the design and delivery of financial services. This includes a wide range of applications, such as mobile banking, investing platforms, cryptocurrency, and digital payment solutions. Fintech companies typically leverage cutting-edge technologies, such as artificial intelligence, blockchain, and big data, to provide faster, more efficient, and more accessible financial services to individuals and businesses.

The rise of fintech has disrupted traditional banking and financial sectors, offering consumers and businesses alternative ways to manage their finances, access credit, make payments, and invest in assets. Fintech has also democratized finance by providing services to underserved populations and small businesses, reducing the barriers to entry that were prevalent in traditional financial institutions.

2. The Growth of Fintech Industry

The fintech industry has experienced rapid growth in recent years, fueled by increasing consumer demand for digital financial services, as well as advancements in technology and regulatory changes. According to a report by Statista, global fintech investment reached over $100 billion in 2020, and the industry is expected to continue expanding in the coming years.

Furthermore, the COVID-19 pandemic has accelerated the adoption of fintech solutions, as more people turned to online and mobile banking, digital payments, and remote financial services. This shift in consumer behavior has created new opportunities for fintech companies to innovate and develop solutions that cater to the evolving needs of consumers and businesses.

3. Impact on Traditional Financial Services

The rise of fintech has significantly impacted traditional financial services, challenging the dominance of established banks and financial institutions. Fintech companies have introduced new business models and technologies that have forced traditional players to adapt and innovate in order to remain competitive.

As a result, many traditional financial institutions have embraced collaboration with fintech companies, either through partnerships or investments, in order to leverage their technological advancements and reach new customer segments. This convergence of fintech and traditional finance has led to the emergence of hybrid financial services that combine the strengths of both sectors.

4. Regulation and Compliance Challenges

The rapid growth of the fintech industry has also brought about regulatory and compliance challenges, as new technologies and business models have outpaced existing financial regulations. Governments and regulatory bodies are working to create a supportive regulatory environment that fosters innovation while ensuring consumer protection and financial stability.

Additionally, fintech companies are faced with the complex task of navigating different regulatory frameworks across multiple jurisdictions, which can be a barrier to expansion and scalability. As a result, there is a growing need for international cooperation and standardization of regulations to facilitate the growth of the global fintech ecosystem.

5. Fintech and Financial Inclusion

One of the key benefits of fintech is its potential to promote financial inclusion by providing access to financial services for underserved and unbanked populations. Through digital banking, mobile payments, and alternative lending platforms, fintech has the ability to reach individuals and businesses that have historically been excluded from the formal financial system.

Fintech solutions have the potential to lower transaction costs, reduce barriers to entry, and extend the reach of financial services to marginalized communities, thereby contributing to poverty alleviation and economic development. However, challenges such as digital literacy, infrastructure, and trust in new financial technologies must be addressed to fully realize the potential of fintech in promoting financial inclusion.

6. Fintech and Personal Finance Management

Fintech has revolutionized personal finance management by offering innovative tools and platforms that empower individuals to take control of their finances. From budgeting apps and automated savings tools to investment platforms and personalized financial advice, fintech has made it easier for individuals to manage their money and make informed financial decisions.

Furthermore, fintech has democratized investment opportunities by providing access to a wide range of asset classes, such as stocks, bonds, and cryptocurrencies, allowing individuals to build diversified investment portfolios and grow their wealth. This shift towards self-directed financial management has empowered consumers and reduced their reliance on traditional financial advisors and institutions.

7. Fintech and Business Finance Solutions

Small and medium-sized enterprises (SMEs) have benefited significantly from fintech solutions that address their financing needs, such as alternative lending, invoice financing, and supply chain finance. Fintech has streamlined the lending process for businesses, providing faster access to capital and flexible financing options that traditional banks may not offer.

Moreover, fintech has improved the efficiency of business operations through digital payment solutions, automated accounting software, and cash flow management tools. By leveraging fintech, businesses can optimize their financial processes, reduce costs, and improve their overall financial performance, contributing to their growth and sustainability.

8. Adoption of Blockchain and Cryptocurrency

Blockchain technology and cryptocurrency have become integral parts of the fintech landscape, offering decentralized and secure solutions for financial transactions and asset management. Blockchain enables transparent and tamper-proof record-keeping, which has applications in areas such as digital identity verification, smart contracts, and cross-border payments.

Furthermore, the rise of cryptocurrencies, such as Bitcoin and Ethereum, has presented alternative investment opportunities and digital payment methods that are independent of traditional financial systems. Fintech companies are exploring the potential of blockchain and cryptocurrency to revolutionize various aspects of finance, including remittances, asset tokenization, and decentralized finance (DeFi).

9. Future Trends in Fintech

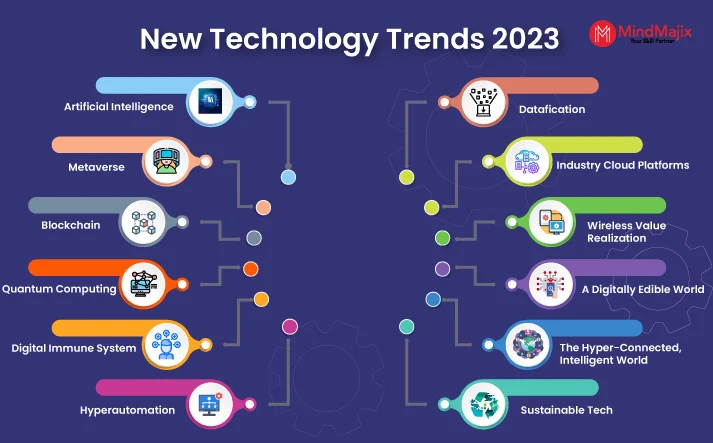

The future of fintech is expected to be shaped by several key trends, including the continued integration of artificial intelligence and machine learning in financial services, the expansion of open banking initiatives, the convergence of fintech and e-commerce, and the development of sustainable and ethical fintech solutions. Additionally, advancements in cybersecurity, data privacy, and regulatory technology (RegTech) will play a critical role in shaping the future of the fintech industry.

Furthermore, the global expansion of fintech, particularly in emerging markets, and the increasing focus on environmental, social, and governance (ESG) factors in fintech investments are expected to drive the next phase of innovation and growth in the industry, creating new opportunities and challenges for fintech companies and financial institutions alike.

10. Conclusion

In conclusion, fintech is a dynamic and transformative force in the financial industry, leveraging technology to drive innovation, accessibility, and efficiency in the delivery of financial services. The evolution of fintech is reshaping the way individuals and businesses manage their finances, promoting financial inclusion, and challenging traditional financial systems. As the fintech landscape continues to evolve, it is essential for stakeholders to collaborate, adapt to regulatory changes, and embrace emerging technologies to unlock the full potential of fintech and address the evolving needs of the global economy.

What Is Fintech And How Is It Developing?

| Term | Explanation |

|---|---|

| Fintech | It is a combination of “financial technology” and refers to the use of technology to improve and automate financial services. |

| Development | Fintech is developing rapidly, with advancements in areas such as mobile payments, blockchain, robo-advisors, and AI-based financial services. |

conclusıon

Fintech, short for financial technology, is the use of technology to enhance and automate financial services. It is rapidly developing with innovations in mobile payments, blockchain, robo-advisors, and AI-based financial services.